Corporate tax filing in Denmark

Filing annual tax returns in Denmark

If you are a business owner in Denmark, you are required to file annual tax returns with SKAT, the relevant Danish tax authority. Entrepreneurs doing business in Denmark can do their annual returns electronically. The process involves using the official website www.skat.dk and a special code, known as NemID or Tastselv. Company data is also required for tax and VAT settlements, which requires a CPR (Personnummer) number assigned by Customs and Taxation.

What should you know about annual settlements for companies in Denmark?

- If you are self-employed in Denmark, you are responsible for a full tax return and entitled to an individual tax credit - Personfradrag, the value of which is determined annually.

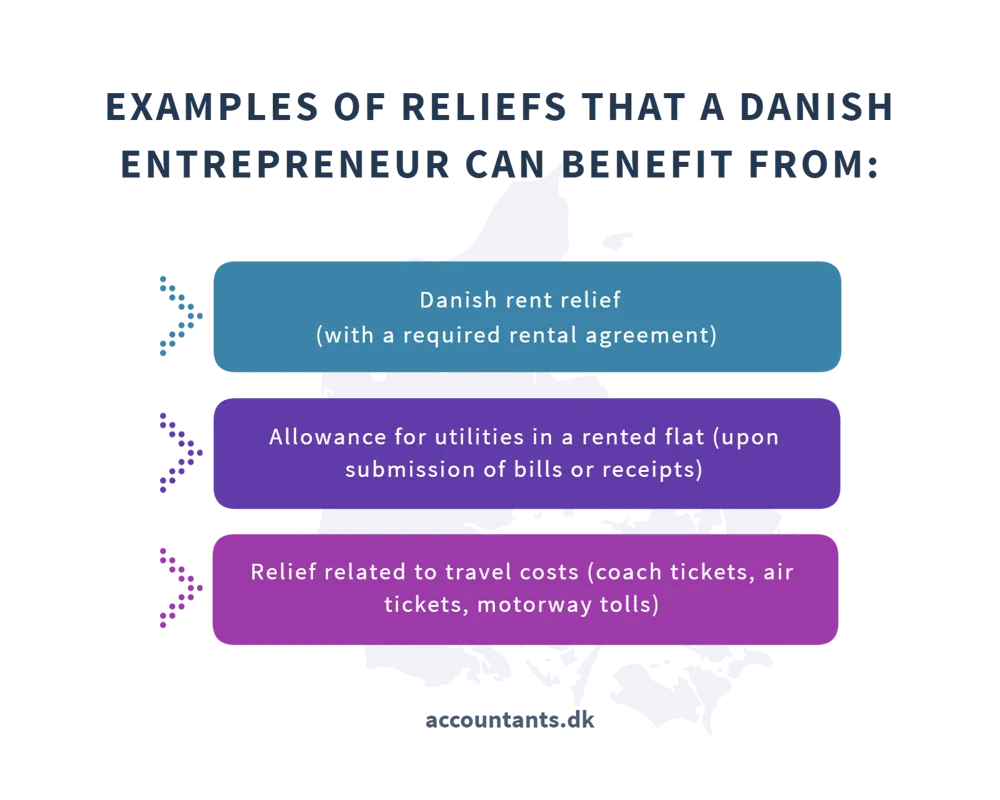

- Entrepreneurs in Denmark can take advantage of other tax breaks and include them in their annual tax returns. These include, among others, an allowance for renting an apartment in Denmark (with a required rental agreement), an allowance for utilities in a rented apartment (upon submission of receipts or transfer receipts), and an allowance for travel expenses (e.g., to the home country, including coach, air and sea tickets, highway tolls, etc.).

- You will receive a special form - Selvangivelse - from SKAT regarding your tax return, sent to the address you provided during registration.

- Those doing business in Denmark must file a tax return before July 1.

- After July 2, SKAT (Skattestyrelsen) sends a document - Årsopgørelse - containing the entrepreneur's tax decision in Denmark. This document indicates the amount to be refunded (Skat til udbetaling, shown in green) or surcharged (Restskat til betaling, shown in red).

- To check your personal settlement, log into your individual SKAT account and click on "Se årsopgørelsen." If you want to make corrections or take into account the allowances you are entitled to, click "Ret årsopgørelsen/oplysningsskemaet."

- The tax refund is transferred to the previously established NemKonto account by the Danish entrepreneur.

- The term "Personlig indkomst" refers to individual income after deducting ATP pension contributions and allowances for pension insurance.

- The term "Kapitalindkomst" refers to income from capitals, such as interest (e.g., from bonds, investments or deposits) after deducting interest expenses associated with loans.

- Capital income (kapitalindkomst) and deductions from capital income (fradrag and kapitalindkomst) are shown on the annual tax return provided by SKAT.

- "Renteindtægter" means interest benefits, and "Renteudgifter" is interest expense.

- In Denmark, companies can file annual tax returns, correct tax declarations or appeal SKAT decisions within 3 years.

- Entrepreneurs in Denmark can deduct insurance premiums, child support, pension contributions, commuting expenses and food expenses. However, the Danish tax authority has the right to check within 7 years whether the expenses described are true.

- Businesses in Denmark can take advantage of the reverse taxation procedure, which means that foreign companies selling goods and services to Danish companies do not have to charge Danish VAT. In this case, the tax is not shown on the invoice, only the net value of the goods or services. To do this, you can use a sample formula, such as "Reversed charge," which means that the buyer should charge and pay VAT on the service, and provide the CVR or SE number (the buyer's registration number).

- All companies offering goods or services in Denmark are required to pay a flat 25 percent VAT. This is a value-added tax applied to the price of services and goods offered by the company, and taxpayers must include it in their annual tax returns.

- Companies in Denmark must register for VAT before providing services and goods (they have eight days to do so).

- The VAT rationale extends to all Danish companies whose annual turnover exceeds DKK 50,000. Then they are required to declare themselves as VAT payers through the RUT platform, the Registry of Foreign Suppliers (virk.dk).

- If a business's annual income in Denmark does not exceed 42,900 Danish kroner, it is entitled to a full tax refund.

- Entrepreneurs in Denmark do not have to pay more than 51.5% tax from the previous tax year.

- Those who operate in Denmark and have their own business are required to file an annual tax return with the Danish tax authorities. These returns take into account all income, both domestic and foreign, in accordance with double taxation agreements.

Danish company tax procedures and documents

If you run a business in Denmark, you are required to file annual tax returns with the Danish Tax and Customs Administration. If you have employees, you must also provide them with the proper paperwork to properly complete their tax returns.

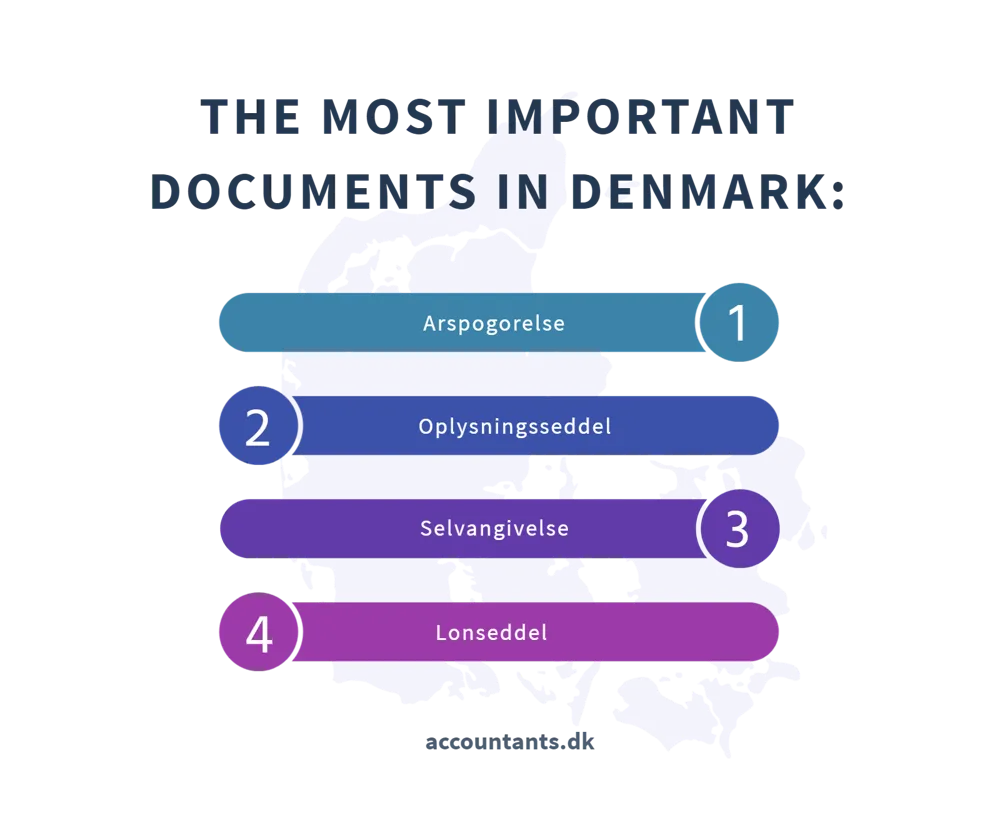

The most important paperwork related to annual corporate tax returns in Denmark include:

- Arspogorelse: This is the official document that is sent by SKAT after July 2. It contains the tax decision, informing of any refund or surcharge due.

- Oplysningsseddel: Provides a detailed overview of an employee's earnings. At the end of each year, every employer in Denmark is required to provide such a document to employees.

- Selvangivelse: This is a tax return form that is delivered by the Danish Tax Authority (SKAT). The form is sent to the address provided during registration.

- Lonseddel: This is the regular salary payment that an employee receives on a weekly or monthly basis. Every employer in Denmark is required to provide such documents to its employees.

Deadlines and conditions for tax returns in Denmark

By July 1, people who do business in Denmark, even those who do not live here permanently, must report. They are required to settle their finances with the state.

Between March 1 and May 1, you need to deliver all tax-related paperwork, unless you don't need to do so or you live here permanently. If you want to deduct something for the past tax year or need to report your income together with your spouse, you have until June 1 to do so.

Once it's past July 2, SKAT, which is a kind of tax office in our country, sends letters to all people telling them how much anyone gets or is expected to pay in tax. The green one means you get the cash back, and the red one means you still have to pay extra.

If you have a company in Denmark, you can either correct your tax papers or file an objection to SKAT within 3 years and 4 months back.

Those who run companies here can get tax breaks, but the state can check for 5 years to see if everything is correct on your return. That's why you need to keep all documents about your expenses for all that time.

Types of annual returns in Denmark

The way in which annual tax returns are filed with SKAT depends on the type of business the entrepreneur chooses to undertake.

There are differences in taxation between different types of businesses, such as sole proprietorships in Denmark, as well as joint stock companies, limited partnerships, general partnerships or limited liability companies (also known as Danish Ltd). It is worth considering which form of business in Denmark, and as a result, which model of taxation and annual obligations to the Danish Tax Authority, will best suit our expectations and available resources.

The following types of business tax returns can be identified in Denmark:

- Annual tax return Enkeltmandsvirksomhed - addressed to sole proprietorships,

- Annual tax return Aktieselskab - A/S - addressed to joint stock companies,

- Annual tax return Interesselskab - I/S - for general partnerships,

- Annual tax return Anpartsselskab - ApS - addressed to limited liability companies,

- Annual tax return Kommanditselskab - K/S - refers to limited partnerships,

- Annual tax return Filial af udenlandsk selskab - assigned to foreign branches of companies,

- Salgskontor annual tax return - attributable to representative offices of foreign companies,

- Andelsforening/Brugsforening annual tax return - attributable to cooperative associations,

- Iværksætterselskab annual tax return - IVS - is addressed to limited liability companies (as of January 1, 2014).

Managers of Danish companies are required to provide a tax return for the previous tax year by July 1.

Annual declaration of a sole proprietorship in Denmark

In Denmark, the Skattestyrelsen Tax Authority (SKAT) treats earnings earned during the course of a self-employed business (Enkeltmandsvirksmhed) as income for the business owner. Accordingly, business taxation is reported using a single return. An entrepreneur who pays taxes and contributions also has access to health and pension benefits, just like standard Danish employees. Every six months or quarter, through the SKAT online platform, it is necessary to provide a mandatory tax return, including both income tax and VAT.

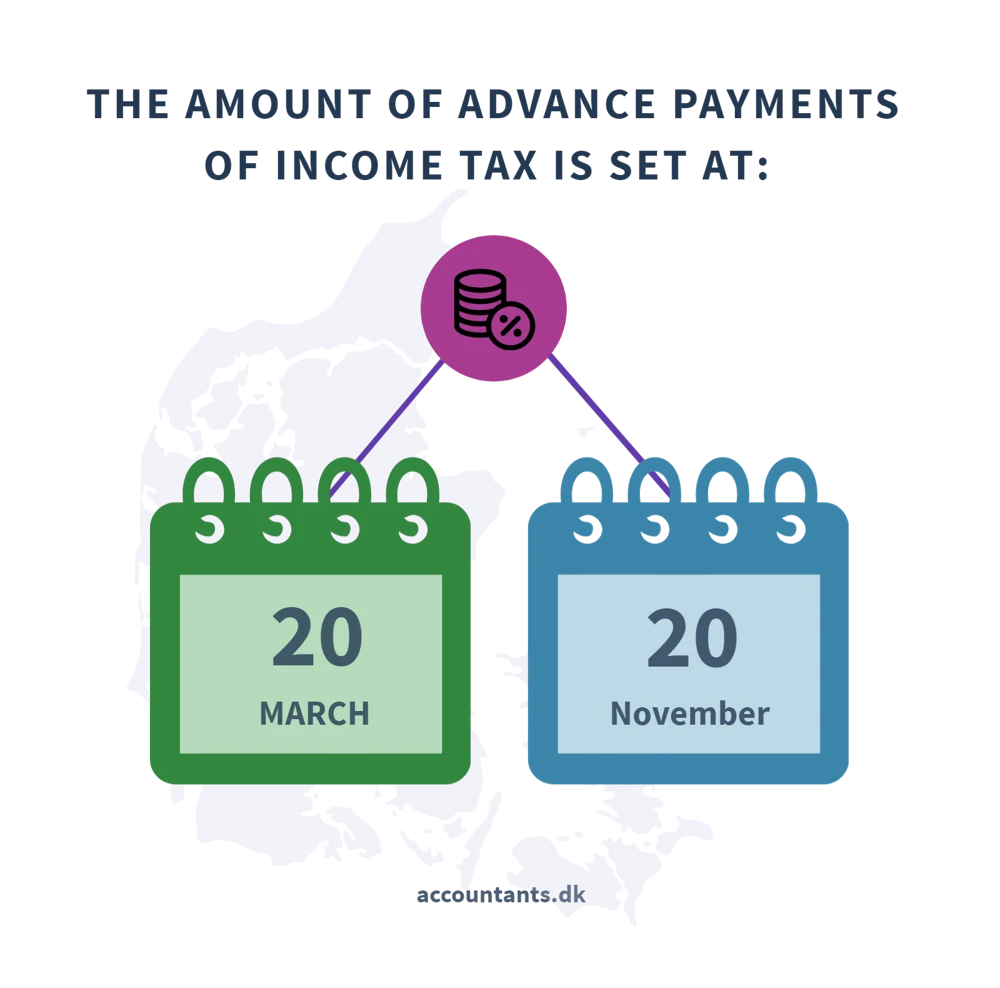

As for income tax, advance payments are made on two dates: March 20 (if you make a larger advance payment, you can receive a tax refund along with higher interest than at the bank) and November 20 (interest is 0.4 lower - meaning that interest is lower than at the bank).

For a sole proprietorship in Denmark, the important deadline is to file the tax return for the previous tax year by July 1. When using the SKAT website to file the tax return, the entrepreneur automatically receives feedback on the tax decision.

What else is worth knowing about the annual tax return procedure for self-employment in Denmark?

- A Danish entrepreneur planning to file a tax return online should first obtain a special code known as TastSelv-kode (available at tastselv.skat.dk), containing 8 digits. This individual TastSelv-kode (or NemID) provides access to personal tax information.

- The owner of a business in Denmark receives a document from SKAT called Selvangivelse, which is a form for tax returns, and after July 2 receives a tax decision - Årsopgørelse.

- In the context of the country, i.e. Denmark, entrepreneurs are allowed to deduct certain costs from tax, such as:

- expenses for goods for sale,

- costs of insurance policies for the company,

- rental fees for the premises,

- computer network costs,

- telephone charges,

- costs related to the company car,

- costs of maintenance and repair of office premises,

- heating costs,

- electricity charges,

- costs for the purchase of machinery, equipment and appliances (if the costs were not included at the time of purchase, they can be recorded as depreciation costs),

- costs related to inventory,

- costs related to auditing services,

- legal costs,

- equipment, machinery, goods and equipment that are used privately, even if they were purchased for the company, cannot be deducted from tax in the company's

- annual return,

- documentation related to the use of deductions that were included in the Danish company's annual return should be kept for five years.

Filing a tax return in Denmark is done online within 6 months of the end of the tax year (whether a calendar year or any other tax year consisting of 12 months). If the tax year ends between February 1 and March 31, the tax return must be delivered by August 1, and tax paid on March 20 and November 20.

Owners of a sole proprietorship in Denmark must choose one of three available taxation options for their business:

- Taxation in accordance with the provisions of the Share Capital Act (Kapitalafkastordning), which allows part of the company's profit to be transferred to personal income and part to capital income;

- taxation of profit as personal income, similar to that for employees;

- taxation in accordance with the provisions of the Enterprise Act (Virksomhedsordning), which makes it possible to deduct costs related to loan interest from tax, and to retain the company's profit in the form of bank savings, which is an advantageous solution.

Annual financial accounting for companies in Denmark

In Denmark, a key obligation for Danish entrepreneurs who choose to establish and operate companies is to pay corporate tax at 22%. When a company's annual revenue exceeds 50,000 Danish kroner, the company becomes a VAT payer at 25%.

For any company operating in Denmark, an income tax settlement is required, covering all income, including income from capital and real estate. This process should be finalized within six months of the end of the fiscal year.

Key details pertaining to annual company settlements in Denmark are:

- For general partnerships (Interesselskab - I/S), annual tax obligations are mainly determined by the owner's previously chosen form of taxation. The person in charge of a general partnership has three options to choose from:

- The option to be taxed according to the capital return regulations (Kapitalafkastordning), which allows part of the profits to be transferred to personal income and the remainder to capital.

- The option to tax profits as personal income, analogous to the taxation of employed persons.

- The possibility of taxation in accordance with regulations for corporations (Virksomhedsordning), which provides the possibility of deducting interest expenses and retaining profits as bank savings.

- For Danish private limited companies (Anpartsselskab - ApS) and joint stock companies (Aktieselskab - A/S), taxation applies to companies that, being individuals, are only liable for the company's capital. Owners of such companies are subject to tax on income or dividends.

- Limited liability companies (Iværksætterselskab - IVS) are subject to corporate taxation regulations, but IVS owners are not required to be taxed under the same rules, as the company is a physical entity. The IVS company must submit regular financial statements.

Company owners in Denmark are required to file a tax return by July 1. They receive a Selvangivelse form from SKAT, which, once completed and taking into account any allowances they are entitled to, they submit via www.skat.dk. Danish company owners must also submit open financial statements.

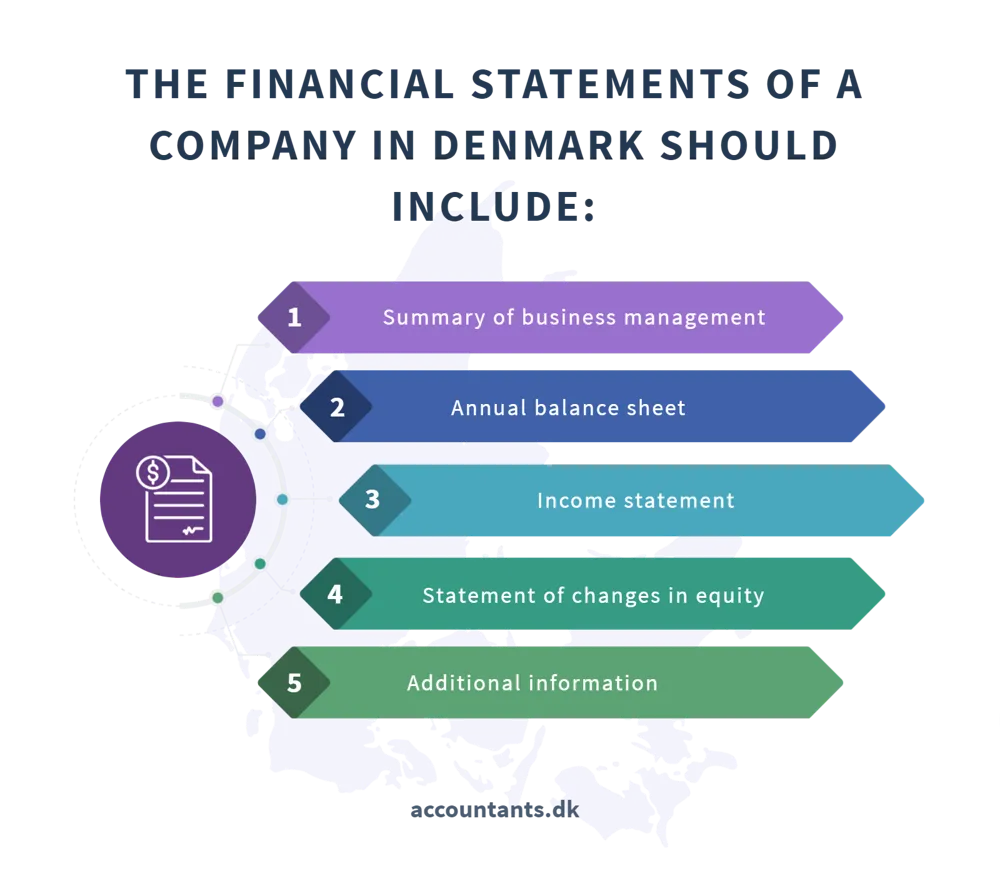

A company's financial statements in Denmark should include:

- summary of the company's business management,

- annual balance sheet,

- profit and loss account,

- statement of changes in equity,

- additional information.

FAQ

- What are the deadlines related to tax returns in Denmark?

For those who pay taxes or are Danish residents, a tax return for the previous tax year is required to be filed by May 1. For Danish entrepreneurs, the deadline is July 1. It is up to SKAT to determine this deadline and is included in the Selvangivelse form provided to the taxpayer. Failure to comply with the obligation to file a return can result in a fine of 5,000 Danish kroner. A person paying taxes in Denmark has 3 years and 4 months to correct the return for a given tax year.

- How does one obtain a Tastselv code?

To obtain a Tastselv code, follow the steps below:- Visit www.skat.dk.

- Click on "Log på."

- Select "Bestil kode."

- Next, select "TastSelv kode."

- Enter the CPR number with a dash in the appropriate field.

- Make a choice of the method of receiving the access password: SMS, e-mail or mail.

- After receiving the code, log in to skat.dk via "Log på med TastSelv kode".

- Enter the CPR number and wait for the code.

- Set a new password, which should be between 8 and 16 characters. Repeat the password and click "FORTSÆT".

- After completing these steps, you can log in with the TastSelv code.

- How do I change my mailing address for the office?

Updating the mailing address for the office can be done at Borgerservice.

- What websites are essential for Danish entrepreneurs?

You should familiarize yourself with the following websites while being an entrepreneur in Denmark:

- Skattestyrelsen - the website of the Danish Customs and Tax Administration, skat.dk.

- Udlændingestyrelsen - the site of the Danish Foreigners Authority, nyidanmark.dk.

- International Citizen Service - site of the information service for foreigners, icitizen.dk.

- Beskæftigelsesministeriet - site of the Danish Ministry of Employment, workindenmark.dk.

- Borger.dk, lifeindenmark.dk.

- What deadlines can we face when completing the annual tax return?

In the annual tax return in Denmark, you may encounter the following deadlines:- Bottom tax (Bundskat): 8%,

- highest tax threshold (Topskat): 15%,

- upper tax threshold to the municipality and the state (Skrå skatteloft), excludes Labor Fund contributions and church tax,

- personal income (Personlig indkomst), including benefits, pension contributions and Labor Fund contributions,

- personal and capital income (Skattepligtig indkomst), after deducting the cost of income, subject to taxation,

- municipal and health tax relief (Ligningsmæssige fradrag),

- capital income (Kapitalindkomst), interest income after deducting interest expense,

- relief deducted from income (Fradrag),

- municipal (municpal) tax (Kommuneskat),

- Labor Fund contribution (AM-bidrag): 8%,

- labor income (inkl. fri bil/telephone) (Lønindkomst), including company car/phone,

- own pension contribution (Eget pensionsbidrag): 5%,

- employee allowances (Personalegoder), such as health insurance,

- interest income (Renteindtægter),

- interest expense (Renteudgifter),

- relief for labor (Beskæftigelsesfradrag),

- relief for travel expenses (Befordringsfradrag),

- craft relief (Håndværkerfradrag),

- taxable income (Skattepligtig indkomst),

- tax calculation (Skatteberegning),

- property tax (Ejendomsværdiskat),

- bottom tax free amount (Personfradrag bundskat),

- municipal tax free amount (Personfradrag kommuneskat),

- accrued tax (Beregnet skat).

- What are the current income tax rates in Denmark?

- For 2019, the following income tax percentages apply in Denmark:

- 8% for income below DKK 50,217,

- 39.2% for income between DKK 50,217 and DKK 558,043,

- 56.5% for income above DKK 558,043.

- How high is the Danish car tax?

Denmark has a so-called luxury tax, which can amount to as much as 180% of the net price of a purchased car.

- What does the term "begrænset skattepligt" mean?

The term "begrænset skattepligt" refers to limited tax liability.

- What is a "sundhedsbidrag"?

"Sundhedsbidrag" is health insurance premiums.

- What is the deadline for filing a corporate tax return in Denmark?

The deadline for companies to file their annual tax return in Denmark is July 1, and filing it with SKAT is mandatory for Danish businesses.

When carrying out important administrative formalities, it is necessary to take into account the risk of errors and their potential legal and financial consequences. To minimize the risk, it is recommended to consult a specialist.