Company in Denmark

Among the places attracting the interest of those who dream of creating and managing their own businesses, the Kingdom of Denmark occupies a significant place. It is a country that is highly regarded by business people due to its favorable business environment and regularly reaches the top of business rankings. For foreign investors, Denmark is an extremely attractive business area. An important aspect is to be thoroughly familiar with local regulations, applicable tax rates, deadlines, and necessary fees and documents to be provided. The goal is to avoid any pitfalls that may be encountered on the business road. Investigating more thoroughly the information available on this site will help you gain a comprehensive knowledge of doing business in Denmark.

Enterprise in Denmark: The process of incorporation and registration

In the economic field, Denmark adheres to the rules of a free market, open competition and no restrictions on starting and running one's own business. When establishing a business in Denmark, the same guidelines apply to all citizens of the European Union:

- The first step is to choose the right form of business and thoroughly understand all legal requirements, such as permits, product designations, patents, licenses, etc.

- Next, it is necessary to familiarize yourself with Denmark's legal system, study the market and analyze the competition.

- It is important to set a start-up date and determine the expected financial aspects.

- Preparing a financial plan in cooperation with an accountant, securing adequate funds for the first year of operation or signing a lease agreement for the premises where the company will operate are other important steps.

- It is also extremely important to present agreements with local business partners with whom you plan to cooperate.

- It is crucial to provide start-up funds (in the range of DKK 10,000 to 25,000), which will be necessary for translations, licenses, consulting support or equipment purchases, among other things. Potential financial support from EU funds is also worth considering.

- The next step is to register the business through the Danish Enterprise and Business Agency's online platform, Erhvervsstyrelsen. This process must be completed no later than 8 days before the start of the business. This agency is a branch of the Ministry of Economic Affairs and forwards the necessary company documents to the Tax Authority - SKAT, where one obtains a CPR tax identification number (personal TIN), necessary for tax and VAT settlements. It is worth mentioning that if the annual turnover does not exceed 50 thousand crowns, company registration becomes optional.

- Apply for an EU/EEA citizen's residence certificate at the local Danish regional office (statsforvaltning.dk). This certificate is mandatory before starting your own business, and it applies to all foreign citizens who plan to stay in Denmark for more than three months.

- In addition, it is a good idea to check with the Danish registrar that the company name you have chosen is unique.

RUT in Denmark: Requirements for foreign service providers

Those interested in starting and operating their own business in Denmark are required to register the company with the Registry of Foreign Service Providers (RUT) before starting work. In addition, any changes to the company must be reported no later than 1 business day prior to their implementation.

Important information about the Registry of Foreign Service Providers (RUT):

- Failure to register a company with the Registry or to provide outdated information can result in prosecution by the Labor Inspector or fines for the business owner. The fines range from DKK 10,000 to 20,000, and can be even higher in the case of multiple violations.

- The Labor Inspector has the right to impose a fine for each day of delay in reporting services to the Registry.

- Danish business owners can obtain relevant information regarding registration with the RUT and applicable labor laws by calling the available telephone number of the Registry of Foreign Service Providers.

- Registration with the RUT is possible through the virk.dk website.

- All employees and employers working or doing business in Denmark must be registered with the Registry of Foreign Service Providers. Once registered, one is given a unique RUT number, which is necessary when dealing with the data authorities.

- Each employee must provide confirmation to the employer with the RUT number, especially important in industries such as construction, horticulture, agriculture, forestry and other cleaning work.

- When registering, information such as contact information, location of activities, type of services provided, activity sector classification code, planned date of work, company name and headquarters, details of employees sent on assignment, duration of assignment, and CVR and VAT registration numbers are required.

All natural or legal persons who provide services in Denmark are considered Danish service providers.

Legal forms for entrepreneurs in Denmark

Taking on our own business in Denmark brings numerous pluses and challenges, so it's worth considering our readiness to take on this challenge and the decision to take the inaugural step into running a personal initiative. Choosing the right legal and tax structure that best fits our skills and abilities is also an important step.

The framework for establishing and operating a business in Denmark includes: the provisions of The Carrying on Business for Profit Act of June 1996; the provisions of The Public Limited Companies Act of June 1973, as amended; the regulations of The Private Companies Act of May 1996, as amended; and the provisions of The Company Accounts Act of June 1996.

Various forms of business are available to both domestic and foreign entities on an equal basis.

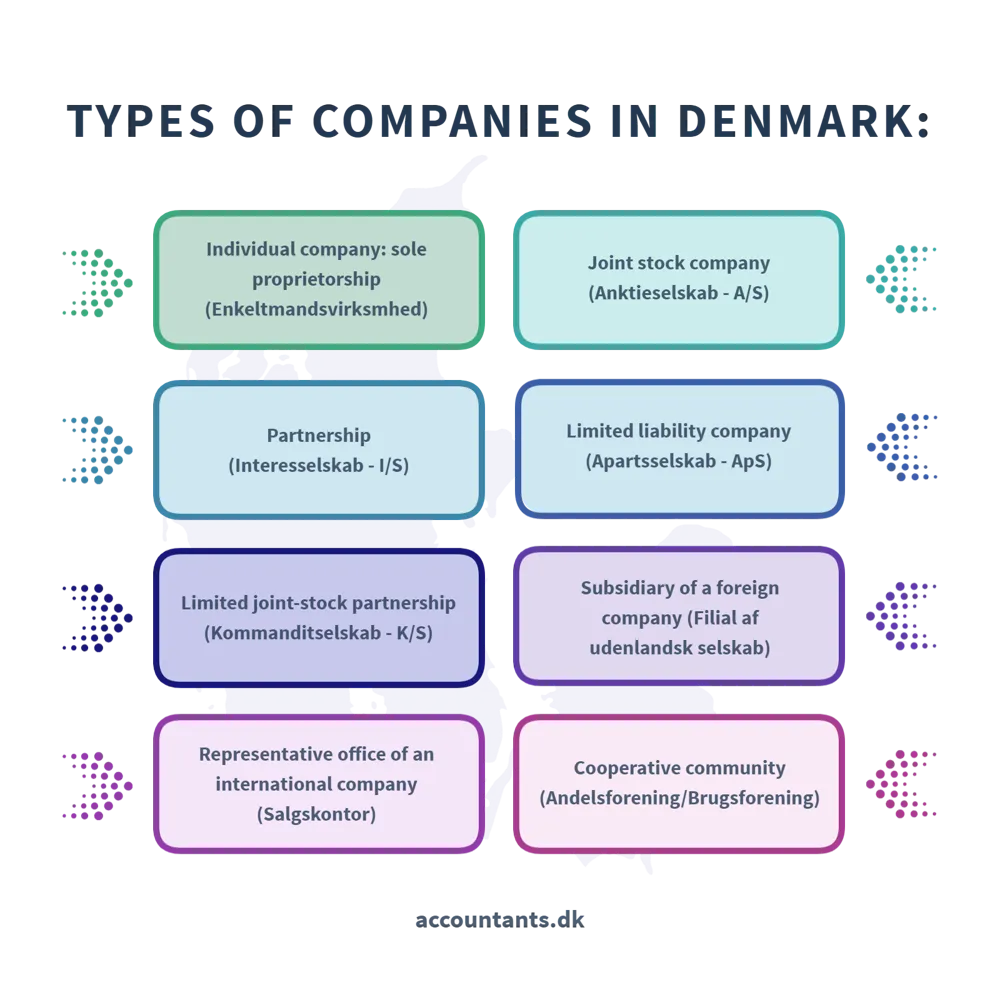

The different types of companies in Denmark are:

- individual company: sole proprietorship (Enkeltmandsvirksmhed),

- joint-stock company (Anktieselskab - A/S),

- partnership (Interesselskab - I/S),

- a limited liability company (Apartsselskab - ApS),

- limited joint-stock partnership (Kommanditselskab - K/S),

- a subsidiary of a foreign company (Filial af udenlandsk selskab),

- representative office of a multinational company (Salgskontor),

- cooperative community (Andelsforening / Brugsforening).

Self-employment - sole proprietorship (Enkeltmandszirksmhed)

The simplest form of business in Denmark is an individual venture. With such an initiative, the manager is personally responsible for business debts and obligations. Business participants use their own CPR registration number, and registration in a self-employment situation is done through Erhvervsstyrelsen (www.erhvervsstyrelsen.dk).

Advantages of Enkeltmandszirksmhed:

- Simplicity in managing such a business.

- No need to accumulate start-up capital.

- Assistance from the Danish administration in the formal aspects of company registration.

- Small costs of opening a business, estimated at about 10,000 Danish kroner (DKK), which translates into about 5,000 zlotys.

- Taxation of the business is done through a single tax return, which means taxing the income once.

- The possibility of delegating power of attorney to other entities to act on behalf of the company.

- Companies whose annual income does not exceed 50 thousand crowns are not obliged to register as VAT payers.

Disadvantages of Enkeltmandszirksmhed:

- The person who oversees the business is fully responsible for the company's financial obligations, as there is no separation between his capital and the company's capital.

- In the event of the owner's death, the business is discontinued, but the company's capital is not isolated from the founder's assets, complicating a potential sale of the company.

- Such a company does not have the option of separate taxation of its income.

A person with a business must select one of three possible taxation options:

- A variant of taxation under the Kapitalafkastordning regulation, which allows a portion of profits to be transferred to personal income and a portion to capital income.

- The option of taxing income as personal income, equivalent to employee wages.

- The alternative of taxation under the Enterprise Act (Virksomhedsordning), which allows for the deduction of loan interest expenses, but also allows company profits to be retained as bank savings.

Joint stock company (Aktieselskab - A/S)

Another option is to form a joint-stock company, bringing together a board of directors, management or supervisory board elected at a general assembly of at least three people (in order to maintain the majority voting principle in making important decisions regarding the company's operations).

Shareholders and owners of the company are not individually liable for the company's obligations, but the bank may demand collateral in case of loans.

Here are the important aspects of setting up a joint stock company in Denmark:

- The joint-stock company form is suitable for medium-sized and larger companies and is the only one that can be listed on the Danish Stock Exchange. An initial capital of DKK 500,000 in the form of cash or other assets is required and must be paid in before the company can be registered.

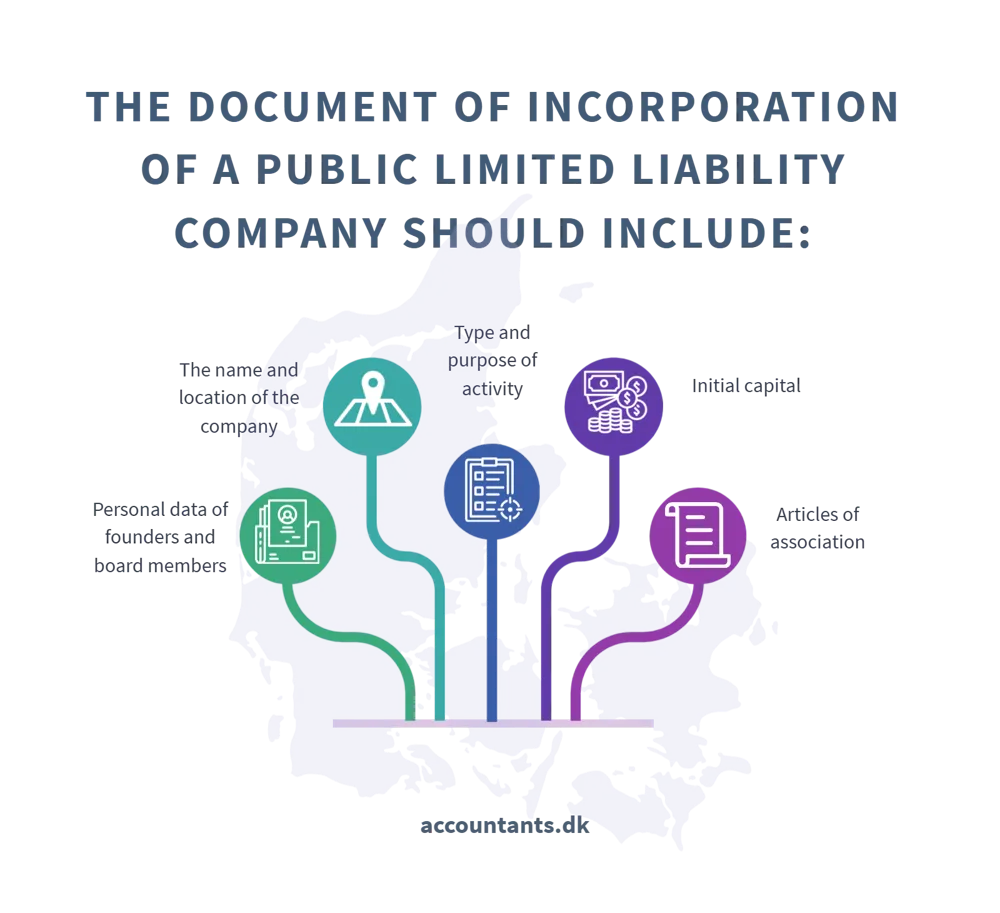

- The founders of a joint-stock company must prepare and sign a founding document, including:

- personal data of the founders and members of the board of directors,

- the name and location of the company,

- the type and purpose of the business,

- initial capital

- it is necessary to prepare the Articles of Incorporation of the company.

- The share capital must be paid up.

- Shareholders elect the board of directors and supervisory board at the charter meeting.

- The company must have at least one shareholder.

- By law, the founders of a company do not necessarily have to be the holders of its shares.

- The minimum number of founders is one.

- Individual shareholders should inform the company within 30 days of acquiring at least 5% of the share capital.

- Shareholders are taxed on the income received, while the company is subject to separate tax regulations.

- All documents must be drawn up in Danish.

- The fee for registering an A/S company through a law firm in Denmark is in the range of DKK 4,500 to 6,000.

- If the term "under registration" (under stiftelse) is added to the company's name, the company has the right to start operations from the date the incorporation document is signed.

- An alternative option is to purchase shares in an existing company that has not yet started operations (known as a shelf company), although this requires more time and resources.

After signing the incorporation document and transferring the initial capital to a bank account, we have 6 months to register the company with the Danish Trade Register. Usually the registration process takes 2 to 3 weeks.

The registered company receives a CVR identification number. The next step after registering the company is to register with the tax authority (Told-og Skatteregion).

General partnership (Interesselskab - I/S)

The formation of a limited partnership requires the joint commitment of at least two natural or legal persons who undertake jointly, and their relationship is formally regulated in a founding agreement.

Key information regarding a limited partnership:

- A limited partnership does not have legal personality, but has the ability to enter into contracts, is entitled to participate in court cases and can assert its rights.

- The value of a limited partnership consists of the components of the contributions and assets acquired by the company during its existence.

- It is important that the name of a limited partnership in Denmark include the abbreviation K/S, which indicates its legal form.

- There is no share capital requirement for the formation of a limited partnership.

- All documents and the registration application should be sent to the Danish Commerce and Companies Agency - DCCA - Erhvervsstyrelsen (erhvervsstyrelsen.dk) within 8 weeks of signing the partnership agreement, in order to obtain a Central Company Register - CVR (www.cvr.dk) number.

- If all participants in a limited partnership seek to limit their liability, registration of the partnership with the DBA is essential.

Limited liability company (Anpartsselskab - ApS)

In Denmark, one choice that is gaining widespread interest is the limited liability company, also known as a Danish Ltd. This form is often preferred by those who plan to keep the business in the family and want to retain personal control.

The Danish company Anpartsselskab - ApS has legal personality and is regulated by the Private Limited Liability Company Act. Establishing this type of company through the services of a law firm entails costs ranging from DKK 3,000 to DKK 5,000.

There is a variety of types of limited liability companies in Denmark:

- Danish limited liability company (Anpartsselskab - ApS).

- An individual limited liability company (Ivaerksaetterselskaber - IVS), introduced into Danish law as of January 1, 2014. This company, like Anpartsselskab - ApS, is subject to the provisions of the Danish Private Limited Liability Company Act. The minimum initial capital for Ivaerksaetterselskaber is just 1 Danish krone or the equivalent in euros. At least 25% of the company's profits from the last 12 months must be allocated to reserves, which are mandatory. Dividends can only be paid if the sum of share capital and reserves reaches 50,000 Danish kroner.

Anpartsselskab - ApS vs Aktieselskab - A/S

- The rules in Denmark that govern a joint-stock company and a limited liability company show some parallels.

- Compared to participants in a limited liability company, shareholders of a joint-stock company have less freedom in making decisions related to the operation of the company.

- The minimum initial capital required for a limited liability company in Denmark is at least DKK 50,000, while A/S companies require at least DKK 500,000 (in various types of assets, with at least DKK 125,000 in cash).

- In both cases, the capital remains with the company, not the owners.

- The approximate cost of establishing an ApA company with the assistance of a professional law firm is DKK 3,000 to 5,000, while for an A/S company it ranges from about DKK 4,500 to 6,000.

- Both limited and joint-stock companies are required to provide annual financial reports (årsrapport), have articles of incorporation (vedtægter) and articles of incorporation (stiftelsesdokument).

- In the case of a Ltd in Denmark (ApS), management must be appointed, while an A/S company has a board of directors (alternatively: a supervisory board) in addition to management.

- Both types of companies must have at least one owner.

- Regulations for both forms of companies are set forth in the Danish Companies Act (Selskabsloven).

- Both companies are subject to tax regulations.

Limited partnership (Kommanditselskab - K/S)

In Denmark, there is also another alternative as to the type of company, namely the limited partnership option, which is available for incorporation. This form requires at least one general partner (e.g., a limited liability company), who assumes full liability for the company's obligations. In addition, a limited partnership must consist of several limited partners, who are liable for the company's debts only up to the amount of the contribution they make to the partnership.

The main information about the K/S partnership:

- The manner in which a limited partnership operates is defined in the Articles of Incorporation, which is an essential document when registering the company.

- Registration of a Kommanditselskab (K/S) is required in the DBA register.

- A limited partnership must be registered when all its partners are legal entities.

- Registration of the partnership should be done by the partners within 8 weeks of signing the agreement at the Agency for Trade and Enterprise (registration form available at www.eogs.dk).

- The name of the company should include the name of at least one of the general partners and the designation K/S, which identifies its legal form.

Another type of limited partnership is a limited liability company in connection with shares - Partnerselskaber - P/S. The partners of such a company are limited liability companies operating publicly, which are liable for the obligations of the company only within the limits of certain shares expressed in specific amounts or full share capital.

Foreign company branch (Filial af udenlandsk selskab)

An additional option for foreign entrepreneurs is available on the Danish labor market, which is to create a foreign branch of a company. This procedure does not require the need for share capital, although it is more time-consuming compared to setting up a traditional company.

Foreign entrepreneurs have the option to open a branch of their company in Denmark, as long as the company registered in another country has the appropriate legal structure in accordance with Danish regulations (e.g. ApS limited liability company or A/S joint stock company).

The most important information regarding a foreign branch of a company:

- The name of the branch should include the term "filial," which means "branch," along with the name of the company and the country in which it operates.

- Branch registration is possible through the erhvervsstyrelsen.dk platform in Denmark.

- In order to register a branch, the appropriate documents are required.

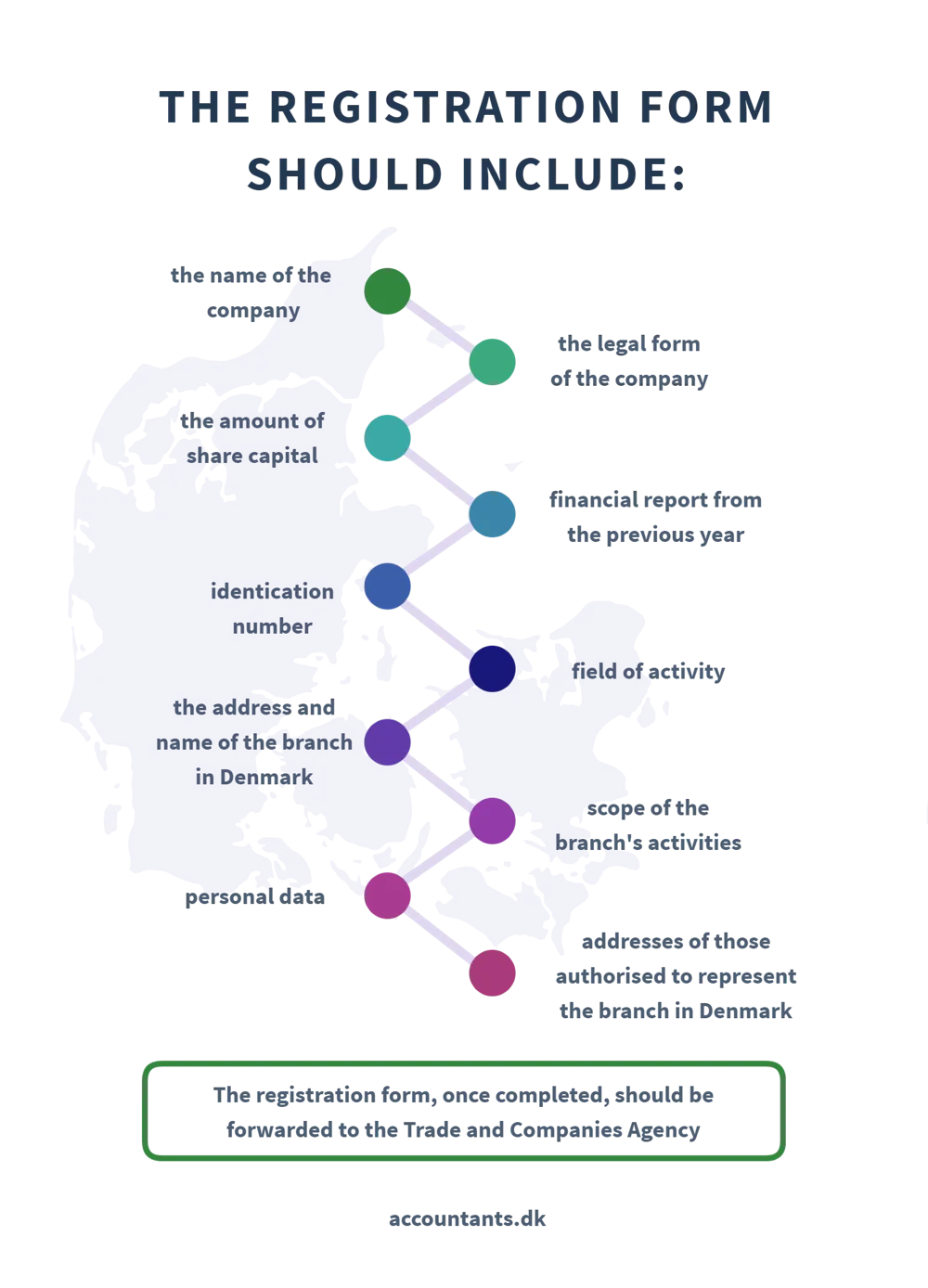

- The registration form, once completed, should be submitted to the Agency for Trade and Enterprise, containing:

- The minimum required share capital is DKK 80,000.

- In order to regulate VAT for the foreign branch of the company, a notification to SKAT (Tax Authority) is necessary.

- The cost of establishing a company branch in Denmark with the support of a lawyer is approximately DKK 8 thousand.

- The company branch is governed by Danish law.

- The branch manager is fully responsible for liabilities.

- Annually, a copy of the company's annual financial report is required to be submitted to the Trade and Enterprise Agency.

- The company's branch in Denmark is subject to 25% corporate tax.

Representative office of a foreign company (Salgskontor)

Entrepreneurs who plan to operate in the Danish market have an additional formal alternative to consider. This involves establishing a representative office of a foreign company to promote the products and services offered (although it does not have the authority to sell them directly).

The representative office of the foreign company, although not a holder of legal capacity, acts as a separate entity acting on behalf of the parent company. The parent company bears full responsibility for all obligations related to the representative office's activities. It is worth noting that the legal provisions for the operation of Salgskontor are not explicitly regulated in Danish law.

Cooperative associations (Andelsforening / Brugsforening)

One possible legal form is the creation of a cooperative association, which is based on the conclusion of an association agreement between individuals. Based on this agreement, activities can be carried out, including both the sale and processing of products that belong to the members of the association. Also, the purchase and resale of goods for the same individuals is possible under this model. Members involved in this cooperative association share responsibility for business obligations in a limited way. An important aspect is the addition of an abbreviation to the name of this cooperative association to indicate its legal form, namely "A.m.b.a." (meaning cooperative association with limited liability).

Taxation in Denmark

In the context of the Danish market situation, it is worth noting issues related to taxation. Denmark has a tax system that includes a progressive increase in tax rates depending on the income earned. The amount of the threshold at which income becomes taxable depends on the amount of income itself. By the way, it is possible to deduct certain expenses from tax, such as insurance premiums, child support, pension contributions and costs related to commuting to work and food. It is worth noting that the tax authority has the right to carry out verification of the compliance of these expenses with reality within seven years.

On the other hand, regarding specific tax aspects in Denmark:

- For 2019, the income tax rates were as follows:

- 8% for income below DKK 50,217,

- 39.2% for income between DKK 50,217 and DKK 558,043,

- 56.5% for income exceeding 558,043 DKK.

- It is also worth noting that an optional church tax of 0.92% can be encountered.

- For companies operating in Denmark, the corporate income tax (CIT) is 22%. Companies with an annual turnover of more than DKK 20,000 also become VAT payers. The rate of this tax is 25%.

- In terms of VAT (value-added taxation), companies with an annual turnover of more than DKK 50,000 are subject to this form of taxation. The VAT rate is 25%. However, there are many exceptions where the VAT rate is 0%, as in the case of certain services or transactions.

- For foreign employees working in Denmark for a period of 3 months to 3 years, with a minimum salary of DKK 47,500, a flat income tax of 25% applies, which additionally includes a 9% contribution to the Danish labor market.

- Companies, both domestic and foreign, that sell services and goods in Denmark are required to pay a flat VAT of 25%.

It is worth noting that registration as a VAT payer is necessary for business owners in Denmark and must be done before starting operations. For foreign companies supplying goods and services to Danish businesses, the reverse charge procedure may apply, which varies depending on the type of goods and services supplied.

Finally, legal entities such as limited liability companies and joint stock companies are subject to tax, while partnerships are subject to different tax rules. Consolidation of company taxation is present in the Danish system, which includes parent companies along with their subsidiaries and branches.

Protection of workers' rights in Denmark

Entrepreneurs in Denmark who decide to hire employees should thoroughly familiarize themselves with the country's labor regulations and the laws that apply to various occupational categories. An example of such regulations is the law relating to employment-related documentation (the Employment Certificate Law), which stipulates that employees hired for at least one month, working more than eight hours a week, are entitled to receive a written document containing key information about their employment conditions.

In Denmark, labor rights often enjoy the support of so-called collective bargaining agreements, which are agreements on working conditions that are negotiated between employers (employer organizations or companies) and employee representatives who operate through trade unions or employee associations.

The scope of a collective agreement includes:

- labor issues,

- determining the time and place of performance of duties,

- wage arrangements,

- regulations on overtime compensation,

- leave arrangements,

- pension issues,

- resolution of possible disputes,

- safety issues in the workplace,

- other aspects regulated by Danish labor law,

- a framework agreement between employer organizations and employee representatives, defining additional guidelines.

All employers in Denmark are obliged to provide their employees with insurance against occupational diseases and accidents, and to provide health and safety training. Also essential is a guarantee of fair wages and a ban on discrimination. If these rules are not followed, unions in Denmark retain the right to organize strikes, lockouts or industrial action on behalf of workers to negotiate better pay conditions. Unions also have the ability to initiate labor conflicts in order to reach a collective agreement.

Denmark also has a law regulating the posting of workers to work abroad.

Safety regulations in the workplace

In Denmark, those who are self-employed or work for a local company must comply with strict labor laws and health and safety regulations. Failure to comply with these regulations can result in financial penalties or even the suspension of the work being performed. The necessary guidelines can be found on the official website of the Danish Labor Inspection Authority (UIP).

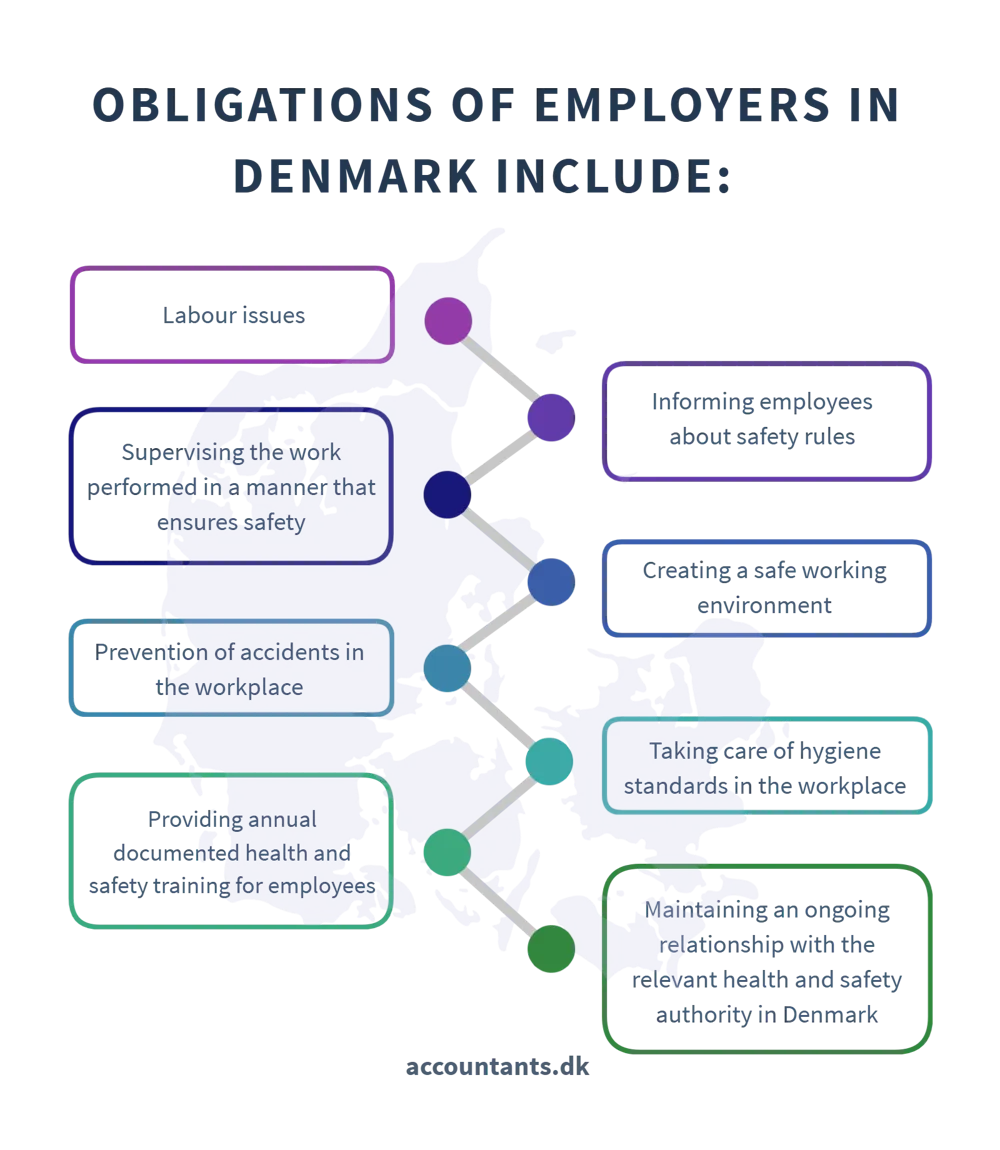

Important obligations of employers in Denmark are:

- providing employees with appropriate personal protective equipment,

- informing employees about safety rules,

- supervising the work performed in a manner that ensures safety,

- creating a safe working environment,

- preventing accidents in the workplace,

- taking care of hygiene standards in the workplace,

- conducting annual health and safety training for employees, with documentation submitted to UIP,

- maintaining ongoing cooperation with the relevant health and safety supervisory institution in Denmark.

The main responsibilities of workers in Denmark are:

- strict compliance with health and safety regulations,

- consistent use of appropriate personal protective equipment,

- respecting the guidelines and rules set forth in regulations and instructions,

- participation in annual training courses on occupational health and safety.

When a Danish company has at least 10 employees, it is required to create a structure responsible for health and safety issues and appoint inspectors to oversee the implementation of safety regulations. The same applies to companies that employ workers in rotating or temporary positions, where the period of employment exceeds two weeks.

Common issues of running a business in Denmark

- The term Denmark Holding Company

The definition of a holding company in Denmark is to function as a holding company that is required to register with the Trade and Companies Authority. Key information related to Denmark Holding Company is presented below:- a holding company in Denmark is Anpartselskab (ApS) - a type of private company,

- Denmark Holding Company has shares in other foreign subsidiaries,

- the holding company has the right to control 100% of the shares in foreign companies,

- profits made by this company are exempt from taxation,

- the minimum required share capital is 125,000 Danish kroner,

- registration of the company can be done with one shareholder,

- no restrictions on the activities of subsidiaries,

- the registration process can be done in one day,

- company accounts are audited annually and registered publicly,

- holding companies hold only foreign shares,

- dividends paid are not taxable.

- Based on the 2009 tax reform, there are different categories of investors depending on their holdings: affiliated investors, who hold shares at 50% of the share capital - exempt from capital gains tax; portfolio investors, who are required to pay capital gains tax when holding shares below 10% of the share capital; subsidiary investors, who are not required to pay tax on profits when holding shares between 10% and 50% of the share capital.

- Compliance obligations

Companies in Denmark are subject to scrutiny by the police, the Tax Authority and the Labor Inspectorate, which oversee registration with the RUT, timely payment of taxes, compliance with health and safety standards and the legality of employment. Failure to comply with these rules can lead to warnings, fines or referral to the courts.

- Establishing a branch vs. a new company

For foreign companies, establishing a foreign branch in Denmark is a good choice. A branch can be opened if the business in another EU country is similar to a Danish A/S or ApS. When setting up a branch, no start-up capital is required, unlike when setting up a new company.

- Exchange rate for Danish kroner

Online exchange offices offer better rates than traditional outlets. It is possible to negotiate margins. An example of a site is: www.rkantor.com.

- Important sites and phone numbers in Denmark:

- erhvervsstyrelsen.dk,

- skat.dk,

- virk.dk,

- statsforvaltning.dk,

- toldskat.dk,

- Registration at Erhvervs-og Selskabsstyrelsen: Kampmannsgade 1, DK-1780 Copenhagen V; Tel: +45 33 30 77 00; Fax: +45 33 30 77 99; E-mail: ckk@erhvervsstyrelsen.dk.

- Company registration procedure

The process of registering a company in Denmark is simple, and involves no restrictions, no competition, and low income tax. Establishing a business can be done through the DCCA (Danish Commerce and Companies Agency) website: www.erhvervsstyrelsen.dk. The new company is assigned a CVR (Central Company Register) number: www.cvr.dk. Registration with Customs and Taxation can be done at www.toldskat.dk.

- Residence certificate

Those planning a longer stay or establishing a company in Denmark must obtain a residence certificate for an EU/EEA citizen from the Danish Regional Office (www.statsforvaltning.dk).

- Invest in Denmark

The Invest in Denmark organization provides entrepreneurs with information on investing in Denmark.

- LetLøn system

The LetLøn tool, available on the Danish Customs and Taxation (SKAT) website, allows you to keep payroll records of small business employees. The system automatically calculates taxes and expenses.

- Afstaelse fee for renting premises

Afstaelse fee for renting premises for business is paid by tenants.

- VAT payer

Entrepreneurs in Denmark must pay CIT and 25% VAT if annual turnover exceeds DKK 20,000.

- Translation of documents

The cost of translating documents from Danish by a certified translator is about DKK 400 per page.

When carrying out important administrative formalities, it is necessary to take into account the risk of errors and their potential legal and financial consequences. To minimize the risk, it is recommended to consult a specialist.