Danish business registration

The current state of the Danish economy

Denmark is a country that attracts investors from abroad, especially with an interest in startup projects that are creative and innovative. Before doing business in Denmark, it is a good idea to familiarize yourself with the economic context there. The country is distinguished by a variety of key sectors, such as food, renewable energy, information technology, maritime transport and biotechnology. Companies in these fields can receive financial support from the state.

Many international investors choose to open a restaurant or café in Denmark, which is an attractive investment concept. Such a strategy does not carry high costs, and often yields profitable results. Danes value spending time with loved ones over food, which makes them visit eating establishments. Also, hairdressing services, tourism activities, hospitality, banking, insurance and the transportation sector are interesting options. The jewelry industry is gaining popularity because Danish residents want to invest capital safely in the face of negative interest rates. This contributes to the availability of cash, which they want to invest in safe options, and precious bullion is becoming an attractive alternative.

Denmark's tax model

In Denmark, every citizen who runs a business or works is obliged to pay taxes. The tax system operates on a progressive basis, where tax rates are based on income. Individuals in Denmark are allowed to deduct expenses, but must provide documentation to support those expenses. If in doubt, the Tax Office has the right to conduct an audit.

There are two types of tax liability in Denmark: full and limited, which depend on various factors, such as residence, type and amount of income, and place of work. Those with limited tax liability are not required to pay taxes on income earned in Denmark.

For those who want to start a business in Denmark, it is important to register the company with the Agency for Enterprise and Trade. It is worth remembering that Denmark does not offer special tax breaks for entrepreneurs. This means that when doing business in Denmark, you have to comply with the general rules of taxation.

- Individuals in Denmark are required to pay taxes, such as income tax and progressive tax. Income tax is a fixed 32%. The progressive tax rate depends on the level of income. For incomes up to DKK 42,000 per year, the progressive tax rate is 5.64%, and for higher incomes it goes up to 15%. The progressive tax covers both income from labor and income from capital.

Income tax is remitted to local authorities, while payments from progressive tax go to the treasury. Danish citizens must pay both taxes regularly, depending on their income.

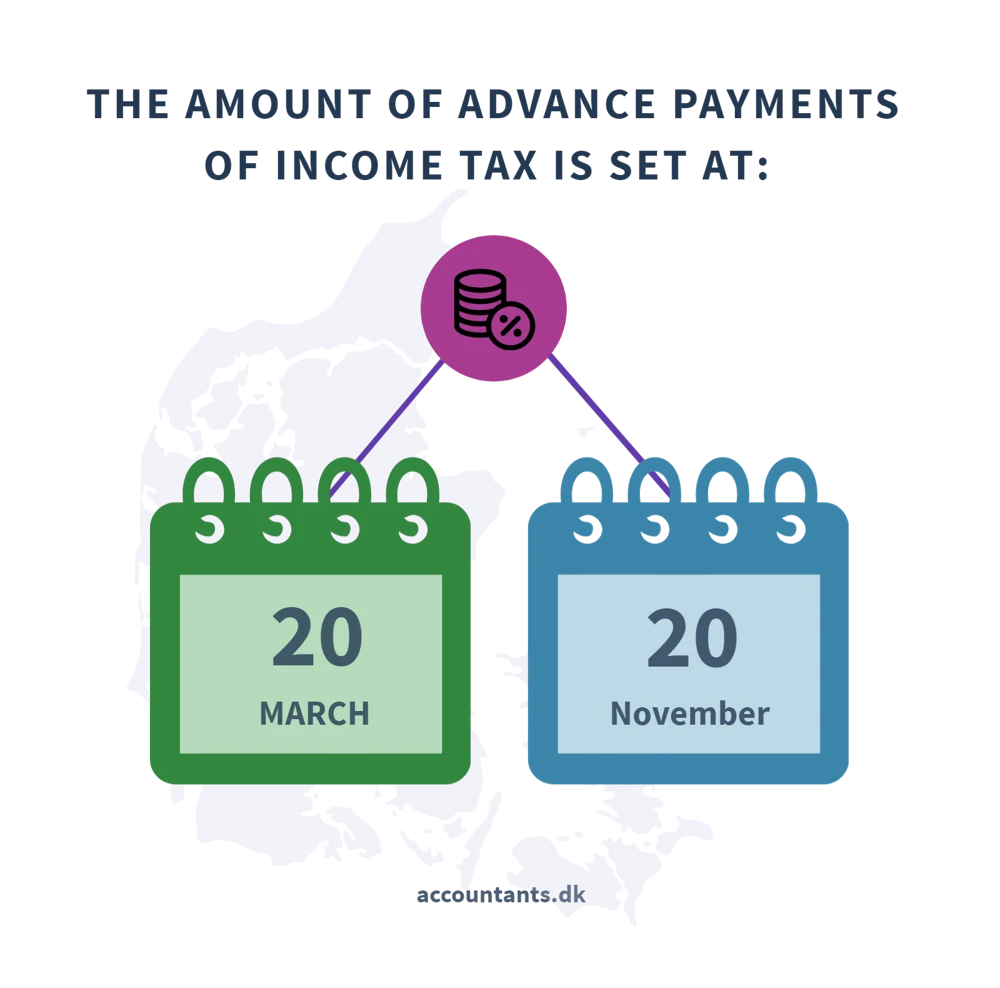

- For sole proprietorships in Denmark, income earned from the business is treated as the owner's income. This means that taxation of both the business and the entrepreneur's other income is individual. Filing a tax return requires quarterly or semi-annual deadlines, depending on the type of business, and can be done online through the Danish Tax Authority's website. Sole proprietors, like those working in Denmark, are eligible for health care and the pension system. The amount of advance income tax payments is set for March 20 and November 20. Payments before the deadline can be refunded at a higher interest rate, while late payments are subject to a reduced interest rate.

- For companies doing business in Denmark, the obligation to pay corporate income tax (CIT) is 28%. Corporate taxation is based on the principle of consolidation, which means taking into account not only the main Danish company, but also its subsidiaries and affiliates. In the case of partnerships, taxation applies only to the companies' shareholders.

- Companies with an annual turnover of more than DKK 50,000 in Denmark must register and pay VAT. The VAT rate is 25% and applies to trading and service companies. In some cases, the VAT rate is 0%, as in the medical sector, real estate sales and rentals, education, the cultural sector, banking and insurance transactions.

- Foreign companies supplying goods or services to Danish businesses can take advantage of the VAT fee refund procedure. Under this procedure, foreign companies do not have to pay VAT in Denmark. Invoices are issued without adding VAT, and the responsibility for paying VAT rests with the purchaser. This procedure covers selected activities, such as construction work or cleaning services.

- Excise taxes in Denmark cover certain product groups, such as alcoholic beverages, tobacco products and engine fuels. Excise duties apply only to end purchasers.

Legal structures of companies in Denmark and the registration process

When preparing to open a company in Denmark, there is an option to choose from various legal structures, such as:

- Individual enterprise (Enkeltmandszirksmhed),

- Limited liability company (Anpartsselskab - ApS),

- Limited partnership (Kommanditselskab - K/S),

- Joint stock company (Aktieselskab - A/S),

- General partnership (Intersselskab - I/S),

- Representative office of a foreign company (Salgskontor),

- Branch of an international company (Filial af udenelandsk selskab),

- Cooperative (Andelsforening/Brugsforening).

Sole proprietorship (Enkteltmandszirksmhed)

When considering options, the sole proprietorship is very popular in Denmark. The registration procedure is simpler, requiring a business plan and documents proving competence. The business operates under the name of the owner or another chosen one. It is worth noting, the lack of legal personality means that the owner is liable for liabilities. The owner is also free to hire employees and grant powers of attorney. With an income of up to 50 thousand crowns per year, it is not necessary to register the company as a VAT payer.

Limited liability company (Anpartsselskab - ApS)

The limited liability company form is often chosen in Denmark. It requires at least one partner and starting capital of at least 125,000 kroner. The owner (partner) is not personally liable for liabilities, and the registration procedure is relatively simpler and cheaper. It is also possible to create a Supervisory Board. The cost of formation is about 3-5 thousand kroner.

Limited partnership (Kommanditselskab - K/S)

A limited partnership requires at least two partners, one of whom is a general partner with full liability and the other a limited partner liable only for his contribution. Registration requires an incorporation agreement, and the deadline is 8 weeks after signing. The name should include the abbreviation K/S.

Joint stock company (Aktieselskab - A/S)

A joint-stock company is an advanced option, requiring at least one shareholder and a minimum capital of 500,000 kroner. The registration procedure is complex, involving EU shareholders and Articles of Association. Registration takes 2-3 weeks, and documentation must be in Danish.

General partnership (Intersselskab - I/S)

A general partnership is an enterprise without a formal legal personality, allowing for the initiation of contracts and participation in litigation. It requires a contract and at least two partners. The registration process is 8 weeks.

Representative office of a foreign company (Salgskontor)

If a company wants to operate in Denmark, opening a representative office of a foreign company can be beneficial. It requires EU partners, and the name should include the name of the mother and "filial." Liability for liabilities rests with the parent company.

Branch of an international company (Filial af udenelandsk selskab)

Establishing a branch of a foreign company in Denmark is a process that requires sending information to the Agency for Enterprise and Trade. It requires a capital of 80,000 kroner and can be costly.

Cooperative (Andelsforening/Brugsforening)

Cooperative association is a rare option, allows commercial activities and product processing with limited liability of members. Requires an association agreement.

Additional issues related to company registration in Denmark

When planning to initiate the process of registering a company in Denmark, there is a need to consider the chosen legal structure, although certain aspects are invariable. In the context of foreign citizens who are members of the European Union, the creation of companies in Denmark is streamlined, it is enough to provide an EU residence certificate. Having a NemKonto bank account also plays a key role. By presenting documents such as the Articles of Incorporation and personal details of the founders, it is possible to register the account. In addition, an electronic NemID/MitID signature is extremely important, allowing access to websites and official government portals. In some cases, special permits or approvals from relevant institutions become necessary for specific fields of activity.

Various costs associated with the company registration process in Denmark include:

- initial capital - depending on the chosen form, from 0 to 500 thousand Danish kroner,

- fee for registration of legal form - 670 Danish kroner,

- development of a digital signature - the first three free of charge, subsequent ones for 80 Danish kroner,

- registration of a trademark or logo - 4,420 Danish kroner for the first, 1,435 Danish kroner for each subsequent one,

- support of a translator, notary or consultant - in the range of 10,000 to 25,000 Danish kroner,

- services of a professional registration company - 65 thousand Danish kroner.

If the registration process is successful, it brings a variety of documents, including a certificate of incorporation, an extract from the DCCA register showing the company's details, an original certificate of participation, a seal, articles of incorporation with apostille, and a power of attorney.

Tax card and tax identification number

In Denmark, people with limited income enjoy an exemption from tax liability and can receive a special "frikort." However, entrepreneurs and investors from abroad need a tax identification number and a tax card. The tax card is provided electronically through the TastSelv tool. The tax identification number and tax card are available after submitting the appropriate application, which can be submitted online or traditionally by filling out form 04.063. The application can be submitted no earlier than 60 days before the planned start of operations in Denmark. For the application to be complete, you must include a copy of your identity document, a residence permit in Denmark, an employment contract, if applicable, and a marriage certificate, if applicable.

Legal stay in Denmark

In the context of staying in Denmark without stop documents, foreign citizens can legally stay in Denmark for a maximum of 3 months, avoiding the formalities associated with these documents. If the stay exceeds this period, it becomes necessary to apply for EU residence registration before the expiration of 3 months. The EU Residence Registration Certificate is a formal confirmation of the legality of staying in Denmark. To obtain it, the reason for the longer stay must be explained. It is worth noting that residents of Scandinavian countries are exempt from the requirement for residence permits.

For those who remain legally in Denmark for a minimum of 5 years, it is possible to apply for permanent resident status. To do so, it is necessary to submit an application to the resident service office (Borgerservice), usually in the municipality concerned, along with a current document confirming registration of EU residency. The effect of this procedure is to obtain an identification number (CPR), a health insurance card and the entry of a residential address. The rules for EU citizens' residence in Denmark are regulated by EU-opholdsbekendtgørelsen.

Speaking of business visas, those planning to travel to Denmark on business, such as for meetings or contracting, can apply for one. The procedure for obtaining a business visa resembles that for Schengen visas and requires an invitation from a Danish company or business partner, including the purpose of the visit, dates, accommodation information and a financial certificate. The visa request is submitted to the Consular Section of the Danish Embassy or the Visa Center, at the earliest 3 months and at the latest 2 weeks before the date of travel. Usually a decision on the visa is made within 10 days, and the cost is 27 euros. In some cases, the wait for a visa may be longer, up to a month or 3 months under special circumstances. For subsequent applications within 5 years, it is possible to use a travel agent to facilitate the application process.

When we talk about applying for business visas, it is necessary to provide various documents, such as a completed applicant form, consent to processing personal data, confirmation of the visa fee, an invitation from a Danish company or business partner, copies of passport pages, proof of payment of health insurance, 2 photos of the applicant and a bank statement. Additional documents required may include information from tax authorities, registration documentation, powers of attorney, information about the company or business partner, and an itinerary. In case the invitee does not cover travel expenses, you need to provide documents proving the applicant's financial capacity. A business visa can be extended by 90 days, but only in justified cases. Entrepreneurs doing business in Denmark also have the option of applying for a multiple-entry visa.

Admission of employees

In Denmark, there are two different classifications of labor regulations, relating to the employment of physical and intellectual workers. Any employer who hires workers is required to provide them with adequate training in health and safety, adequate wages, and protection against occupational diseases and accidents. Failure to comply with these provisions can lead to strike incidents, paralysis of operations and tensions between the employer and employees.

Working hours

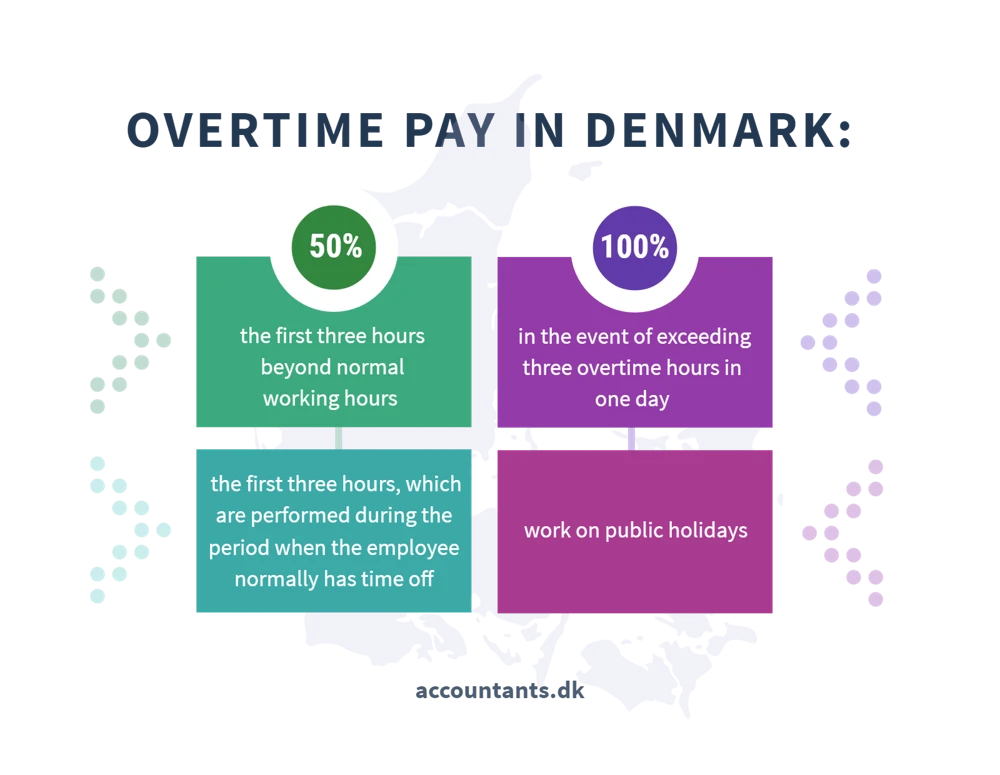

In a standard Danish company, the set number of hours set aside for employees to work is 37 hours per week. Recognized as overtime are the first three hours in excess of normal working hours, or the first three hours that are performed during a period when the employee normally has time off. When an employee performs overtime, he or she is paid an additional 50%. However, if he exceeds three overtime hours in a single day or works on holidays or vacations, the bonus increases to 100%. The employee has a choice between additional overtime pay and the option to take time off instead. Part-time employees have the same rights as full-time employees.

Salary

In Denmark's particular legal system, there is no set minimum wage. Instead, wage issues and working conditions are negotiated between employees and employers. Despite the lack of a general minimum wage applicable across the spectrum of the labor market, minimum wages in specific fields and professions are set through collective agreements. The value of wages depends on the nature of the work and can be expressed as a rate per hour, per day or per month. Payments can be made once or twice a month, while wage amounts in different sectors are updated annually.

Leave for employees

In Denmark, issues related to employees' rest time are regulated through relevant laws. Everyone working is entitled to a total of five weeks off, which equals 30 days, including working days. Employees working second or third shifts receive an additional two hours of vacation for each week spent at work. A minimum of 18 days of continuous vacation must be taken by the employee between May 1 and September 30. If an employee has not had a chance to work the entire previous calendar year, the vacation entitlement is calculated on the basis of full months worked, granting 2.08 days of vacation for each of those months, respectively.

Termination of contract

Each variety of termination of employment has its own individual notice period, which varies and depends on the period of service. The length of this period is a topic that the employer and employee can determine through negotiation. The rules for the termination of employment contracts are defined within the framework of collective agreements and vary depending on the sector and employee role. Among the recognized rules, there is a rule that an employee who has worked at least nine full months and has reached the age of 18 can only be dismissed if the employer has a legitimate reason. If the employee believes that the dismissal is unjustified, he or she has the right to file a complaint with the court or appellate authority. If it is proven that the employer acted unreasonably, he is obliged to pay appropriate compensation to the employee. However, there is an exceptional situation in which the employer has the right to dismiss an employee immediately and without notice if the employee's behavior is grossly inappropriate.

Health and hygiene protection in the workplace

Entrepreneurs who operate in Denmark must respect the guidelines for health and hygiene protection in the workplace. These guidelines are available on the official website of the Labour Inspectorate of Denmark. If a company has at least 10 employees, it is also necessary to set up a structure responsible for health and safety issues, headed by designated inspectors. Their key role is to implement and enforce safety standards within the company. Also, organizations that operate in changing or temporary conditions are required to comply with these regulations. Failure to comply with health and safety requirements can result in financial fines and the halting of work.

The following are the employer's main tasks under Danish health and safety regulations:

- creating a risk-free work environment,

- maintaining high hygienic standards at workplaces,

- providing instruction to employees on safety rules,

- providing regular health and safety training,

- providing appropriate protective equipment to employees,

- monitoring compliance with safety rules by employees,

- implementing preventive measures to minimize the risk of accidents during work.

Work environment

In Denmark, there is no single coherent piece of legislation governing the relationship between employees and employers. Issues such as working hours, notice periods, minimum leave and retirement age are determined through an agreement between the Danish Federation of Trade Unions and the Danish Confederation of Employers. Agreements between employers and employees are required to be in writing; verbal agreements are not considered. Negotiations for salary increases can be conducted about every two years, and the concluded employment contract can be renegotiated on average once every four years or so.

Collective agreements

In the context of Danish companies, there are collective agreements to safeguard employees on issues related to their working conditions. These agreements regulate a variety of aspects, such as terms and conditions of employment, wages, workplace safety, time and place of work, vacations, overtime, as well as pension issues and many others. Representatives of both employees and employers are involved in creating these collective agreements. If an employer shows interest, he has the opportunity to join such an agreement, especially if he is already a member of an employer organization. It is worth noting that the fact that employees belong to a particular labor organization does not automatically entail the implementation in the company of the rules and regulations established by this association within the framework of collective agreements.

Social security contributions

In terms of the social security system in Denmark, all those who take a job in the area are covered by the mechanism. Employers are responsible for paying social security contributions on employees' wages. The amounts of these contributions are approximately DKK 1,080 per year. In Denmark, employers pay an average of 10,000 to 12,000 Danish kroner each year as social security contributions related to the employment of employees.

Register of Foreign Service Providers

The content stresses the importance of the need to record the company's activities in the Registry of Foreign Service Providers (RUT) before operating in Denmark, and also provides information on the obligation to report any modifications to the company's operations. The procedure for registering with the RUT is extremely simple and quick, and is done through the virk.dk website. Specific information is required, such as the name and registered office of the company, the type of services offered, the location, the planned period of operation, the CVR number, the VAT number, the sector classification, the contact details of the registrant and the details of delegated employees. Upon successful registration, one obtains a unique RUT number, indispensable for communication with Danish authorities. Failure to declare activities in the RUT or neglect to report changes in activities carries the risk of a fine or the initiation of an inspection procedure by the Labor Inspectorate.

Buying a ready-made enterprise

An alternative to starting a new company is to buy an existing one. In Denmark, this option is easy and quick to implement, and all paperwork can be handled online. Businesses available for sale usually have been in operation for a few months and have a generic name, making them versatile. Individuals who acquire such companies benefit from avoiding past liabilities, having knowledge in financial matters and recognition in the eyes of banking institutions, government agencies and business partners. The only thing that needs to be arranged is the opening of a bank account for the newly acquired company.An alternative to starting a new company is to buy an existing one. In Denmark, this option is easy and quick to implement, and all paperwork can be handled online. Businesses available for sale usually have been in operation for a few months and have a generic name, making them versatile. Individuals who acquire such companies benefit from avoiding past liabilities, having knowledge in financial matters and recognition in the eyes of banking institutions, government agencies and business partners. The only thing that needs to be arranged is the opening of a bank account for the newly acquired company.

Start-up Denmark

The text emphasizes the need to register a company's operations with the Danish Registry of Foreign Services (RUT) before starting operations in Denmark, and notes the obligation to report any changes in the operation of the company. The Start-up Denmark program, a joint project of the Danish Ministry of Business and Growth and the Ministry of Immigration, Integration and Housing, provides an option for investors from outside the country. It prepares the ground for starting a business in Denmark and allows two people to obtain a residence permit for up to two years. The program's main goal is to stimulate foreign investment, which contributes to the country's economic dynamism.

To participate in the Start-up Denmark program, it is necessary to have a business idea that will bring new value to the Danish economy. Applications from investors outside the country are reviewed by experts who decide whether to accept or reject the proposal. Note that the program does not cover entrepreneurs planning to open a restaurant or grocery store. The investor should hold shares in his home country and not be a dividend recipient. In addition, he or she should have an adequate amount of savings, enough to cover the expenses of one person or family for a year. The minimum amount of savings is about €18,000 for a single stay, €36,000 for two people and about €6,000 for each child.

The Start-up Denmark program process consists of the following steps:

- Business plan application - Submission of a business plan, including essential elements such as a description of the products or services, a detailed business model and the required skills of the business partners.

- Awaiting evaluation - After submitting the business plan, the investor awaits the Danish expert's opinion. A decision is announced within six weeks. Approval of the plan is notified by an official letter.

- Submission of applications - Once the expert approves the business plan, the investor submits two applications: for participation in the program and for a residence permit. Both applications are directed to the Danish Agency for International Recruitment and Integration.

- Final approval - After going through the previous stages, the investor waits for the program organizers' final decision. The average waiting time is about four weeks. If the applications for the program and the residence permit are approved, the out-of-country investor can move to Denmark and implement his business plans.

Entrepreneurs who successfully complete the Start-up Denmark program process get the same privileges as Danish entrepreneurs. They can take advantage of state subsidies and support, establish business relationships and gain access to the European market. In addition, they have access to free consultations at business centers. The non-Danish investor and his family also have access to social benefits, including health care and education.

Terminating the operation of a company in Denmark

To terminate the operation of a company in Denmark, there are a number of formalities, including adjusting the tax return. Visiting the Tax Office and providing the necessary information will calculate the tax due to be paid. The country in which the tax must be paid depends primarily on factors such as the place of residence and the type of work performed. The final form that needs to be filled out before the end of the activity is selected depending on the tax capacity of the person. There are two main categories of tax capacity.

Tax capacity options:

- Limited tax capacity:

- residing in your home country for more than six months during a calendar year,

- working or conducting business in Denmark,

- life interests concentrated in the home country,

- partner or spouse residing in the home country.

- Full tax capacity:

- residence in Denmark or residence for more than six months during a calendar year,

- working or conducting business in Denmark,

- life interests centered in Denmark,

- partner or spouse residing in Denmark.

Naturally, an individual's personal situation may vary and may not necessarily conform to the criteria of limited or full tax capacity. If a person lives and works in both Denmark and his home country, where the majority of life interests are located and where the partner or spouse resides determines which country is considered permanent residence. If the center of a partner's life interests and residence is the partner's home country, that country is considered the place of permanent residence. Similarly, if Denmark is the center of life interests and the partner lives in Denmark, then Denmark is considered the permanent residence. In addition to correcting your tax return, you also need to inform the tax office of your new address and deregister from the Danish national register, which can be handled at your local resident service desk.

Is it profitable to own a business in Denmark?

Denmark is an attractive destination for foreign investors, attracting them with many benefits. Its economy demonstrates stability, flexibility and openness, and its GDP ranks among the top in both Europe and globally. Compared to other European countries, inflation in Denmark is conservative. Bureaucracy is not cumbersome, and political, legal and tax aspects are clearly defined, making it easy for foreigners to navigate. In addition, Denmark is an active participant in such organizations as the European Union, the Council of Europe, the World Trade Organization, the European Free Trade Association, the Organization for Security and Cooperation in Europe and the Organization for Economic Cooperation and Development.

The rich educational offer contributes to a high level of education, which manifests itself in the availability of skilled and well-trained workers in the labor market, which is an asset to potential investors. Significant English proficiency in Danish society facilitates effective communication, both in daily life and in formal matters and contacts with local residents.

The procedure for establishing a company in Denmark is characterized by speed, simplicity and low costs, making it one of the most facilitated processes worldwide. Foreign companies enjoy equal privileges as Danish companies. The state focuses on supporting business development, especially for small and medium-sized enterprises. Entrepreneurs can take advantage of various grant programs, loans and credits. The availability of various legal forms allows business to be tailored to individual requirements.

Corporate income tax rates in Denmark are relatively low, at 28%, an advantage over European averages. Social security and health insurance fees paid by employers are also moderate, limited to 1% of salary. What's more, most cases allow the avoidance of double taxation thanks to agreements Denmark has signed with many countries, whether in Europe, Asia or America.

When carrying out important administrative formalities, it is necessary to take into account the risk of errors and their potential legal and financial consequences. To minimize the risk, it is recommended to consult a specialist.