Denmark accounting

Diverse economic activity models - from companies to individual businesses - are emerging in the area of Danish accounting. Differences in the accounting context between companies manifest themselves through varying degrees of difficulty, different documentation requirements, tax issues, specific deadlines and aspects related to legal and financial regulations. If you are considering setting up your own business in Denmark, it is advisable to consider an accounting strategy for your local business. Options include self-administering your company's accounting in Denmark or using professional support from certified accounting professionals. Competent accounting experts efficiently manage the affairs of a business, guiding through issues related to accounting regulations in Denmark, the structure of accounting accounts and reporting issues. In addition, they will provide information on the employer's rights and obligations related to this area.

What areas does accounting in Denmark focus on?

The area that Danish accounting deals with is the sphere of activity of any entrepreneur who runs his own business in Denmark. They include various aspects that you need to gain knowledge of and implement correctly in order to avoid severe financial consequences. We present below a summary of key topics related to accounting in Denmark:

- regulations governing the field of accounting in Denmark,

- accounting for companies doing business in Denmark,

- guidelines for deadlines, documentation, fees and rates applicable to various types of business activity,

- registration procedures and required permits,

- duties assigned to employers in Denmark,

- classification of reporting tasks,

- structure of the accounting account system within Denmark,

- the procedure for registering business activity in Denmark,

- settlement processes and adjustments within the SKAT system,

- concepts such as Nemkonto, Tastselv, Pension, CPR, A-kasse and the health card (DK),

- accounting designed for one-person companies operating in the Danish area,

- conducting audits of Danish companies,

- issues related to taxation, insurance and benefits,

- fundamental principles underlying Danish accounting.

Organization of the accounting account structure in Denmark

In Denmark, there is a specific arrangement of accounting accounts that is used in specific companies in order to monitor company activities transparently.

Here is a list of the main categories of accounting accounts in Denmark regarding the profit and loss account structure:

- Accounts related to sales revenue generation:

Account number: 1100, Description: sales turnover.

- Accounts relating to production costs:

Account number: 2100, Description: production costs.

- Accounts covering various external costs:

Account number: 3100, Description: advertising expenses.

Account number: 3200, Description: local expenses.

Account number: 3300, Description: cash deficit.

Account number: 3400, Description: vehicle export costs.

Account number: 3900, Description: other expenses.

- Accounts that include the employer's liabilities:

Account number: 4100, Description: salaries of employees.

Account number: 4200, Description: pension contributions.

- Accounts relating to depreciation:

Account number: 5100, Description: vehicle depreciation.

Account number: 5200, Description: depreciation of equipment.

- Accounts related to interest:

Account number: 6100, Description: interest (income).

Account number: 7100, Description: interest (expenses).

- Accounts covering extraordinary events:

Account number: 8100, Description: extraordinary gains.

Account number: 8200, Description: extraordinary losses.

- Accounts related to taxation:

Account number: 9000, Description: corporate income tax.

Layout of accounts related to the balance sheet:

- Fixed Asset Accounts:

Account number: 112, Description: fixed assets.

Account number: 11120, Description: vehicles.

Account number: 11121, Description: depreciation allowances for vehicles.

Account number: 11130, Description: furniture.

Account number: 11131, Description: depreciation write-offs for furniture.

- Current asset accounts:

Account number: 121, Description: inventory.

Account number: 12110, Description: materials in stock.

Account number: 122, Description: accounts receivable.

Account number: 12210, Description: receivables from customers.

Account number: 12220, Description: accruals.

Account number: 123, Description: cash.

Account number: 12310, Description: cash.

Account number: 12320, Description: bank account.

Account number: 1230, Description: savings account.

- Capital Accounts:

Account number: 121, Description: share capital.

Account number: 134, Description: capital reserve.

Account number: 135, Description: financial result.

- Accounts payable:

Account number: 141, Description: long-term liabilities.

Account number: 14110, Description: mortgage loans.

Account number: 142, Description: short-term liabilities.

Account number: 14210, Description: working capital loans.

Account number: 14220, Description: receivables.

Account number: 14230, Description: pension contributions.

Account number: 14240, Description: labor market contributions.

Account number: 14250, Description: taxes.

Account number: 14250, Description: tax settlements.

Account number: 14290, Description: other liabilities.

Account number 21000, Description: profit and loss account.

Account number 22000, Description: balance sheet.

Accounting for enkeltmandsvirksomhed (one-person company)

With regard to sole proprietorships in Denmark, accounting issues are relatively clear. According to the provisions of the Danish Financial Reporting Act, such businesses are assigned to Category A.

One-person operations, known as "Enkeltmandsvirksomhed," mainly focus on tax returns in connection with the Danish Tax Authority (SKAT, www.skat.dk). As for annual reports, which include a profit and loss statement, balance sheet, additional information, accounting policies and management summary, their submission is not mandatory.

In the context of accounting for such a business in Denmark, an important aspect is the development of a Forretningsplan, a detailed description of the planned business venture. This plan should include the business vision, business concept, scope of operations, responsibilities and financial availability of the entrepreneur.

The process of registering a sole proprietorship with the Danish Erhvervsstyrelsen (via www.virk.dk) is necessary, and those opting for this form of business should use an individual CPR registration number. Accounting management of such a business is relatively simpler; no share capital is required, and registration costs are about DKK 10,000 (PLN 5,000). Taxation of this business is based on a single tax filing, and income is taxed only once. The owner also has the option to grant power of attorney to others to represent the company, and registration of the company as a VAT payer is not necessary if the annual income does not exceed DKK 50 thousand.

With "Enkeltmandsvirksomhed," the owner is personally liable for the company's debts and has three choices of taxation:

- The option of taxation according to the Share Capital Act (Kapitalafkastordning), which allows a portion of the company's profit to be shifted to personal income and a portion to capital income.

- The option to tax profit as personal income, analogous to salaried employees.

- The choice of taxation in accordance with the Enterprise Act (Virksomhedsordning), which allows for the deduction of interest expenses on loans and the storage of company profits in a savings account, which can also be beneficial.

If you are a sole proprietor and pay taxes and insurance premiums, you are entitled to pension and health benefits, just like employees working in Denmark. On a quarterly or semiannual basis, a tax return (for income taxation and VAT) must be submitted via the SKAT (Danish Tax Authority) website via the LetLøn system. Advance income tax payments must be made by March 20 and November 20.

The financial dimension of company operations

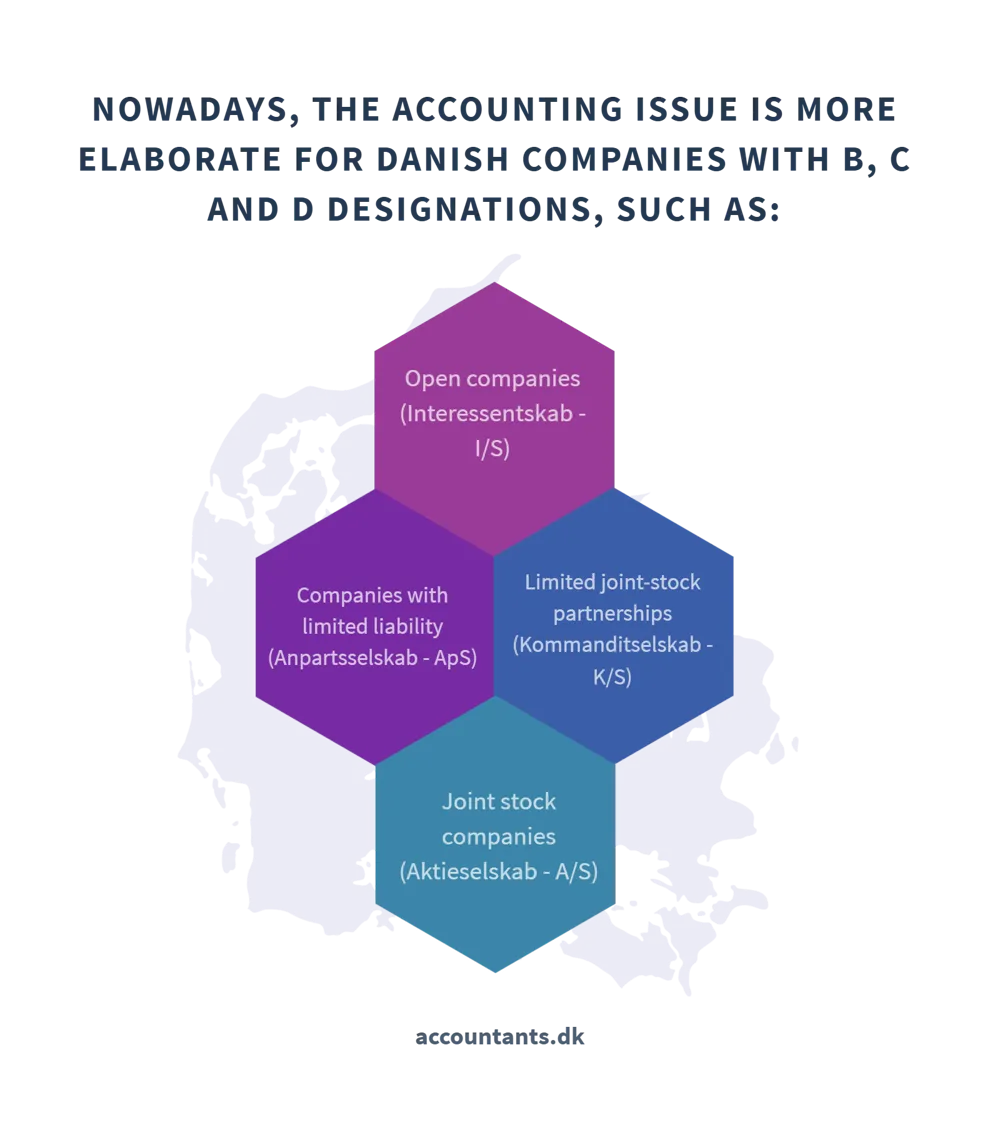

Nowadays, the accounting issue is more elaborate for Danish companies with B, C and D designations, such as:

- open companies (Interessentskab - I/S),

- companies with limited liability (Anpartsselskab - ApS),

- limited joint-stock partnerships (Kommanditselskab - K/S),

- joint-stock companies (Aktieselskab - A/S).

Under regulations in the Danish Financial Reporting Act, these organizations are required to produce reports that include a report from the board of directors, a cash flow analysis, a statement of profit and loss, a balance sheet, information on changes in capital and other additional information.

All Danish companies listed on the regulated market are required to comply with IFRS standards when creating their financial statements.

Here are more key elements related to accounting for Danish companies:

- When establishing and operating a company in Denmark, there is a corporate income tax (CIT) of 22%. If a company's annual revenues exceed DKK 20,000, the company becomes a VAT payer at 25%.

- The Danish Enterprise Authority is responsible for all changes in business and accounting regulations.

- The DASC (Danish Accounting Standards Committee), operating under the auspices of the FSR, provides optional technical standards and guidelines for creating financial statements for companies that are not listed on the stock exchange.

- International Financial Reporting Standards (IFRS) are a set of standards, interpretations and structures developed by the International Accounting Standards Board (IASB).

- IFRS are seen as a compilation of principles-based standards that establish general rules, as well as defining specific approaches.

- These guidelines allow companies to align management with the "comply or explain" principle. Their non-compliance is due to the companies' choice, not contrary to the recommendations.

Organization of reporting requirements

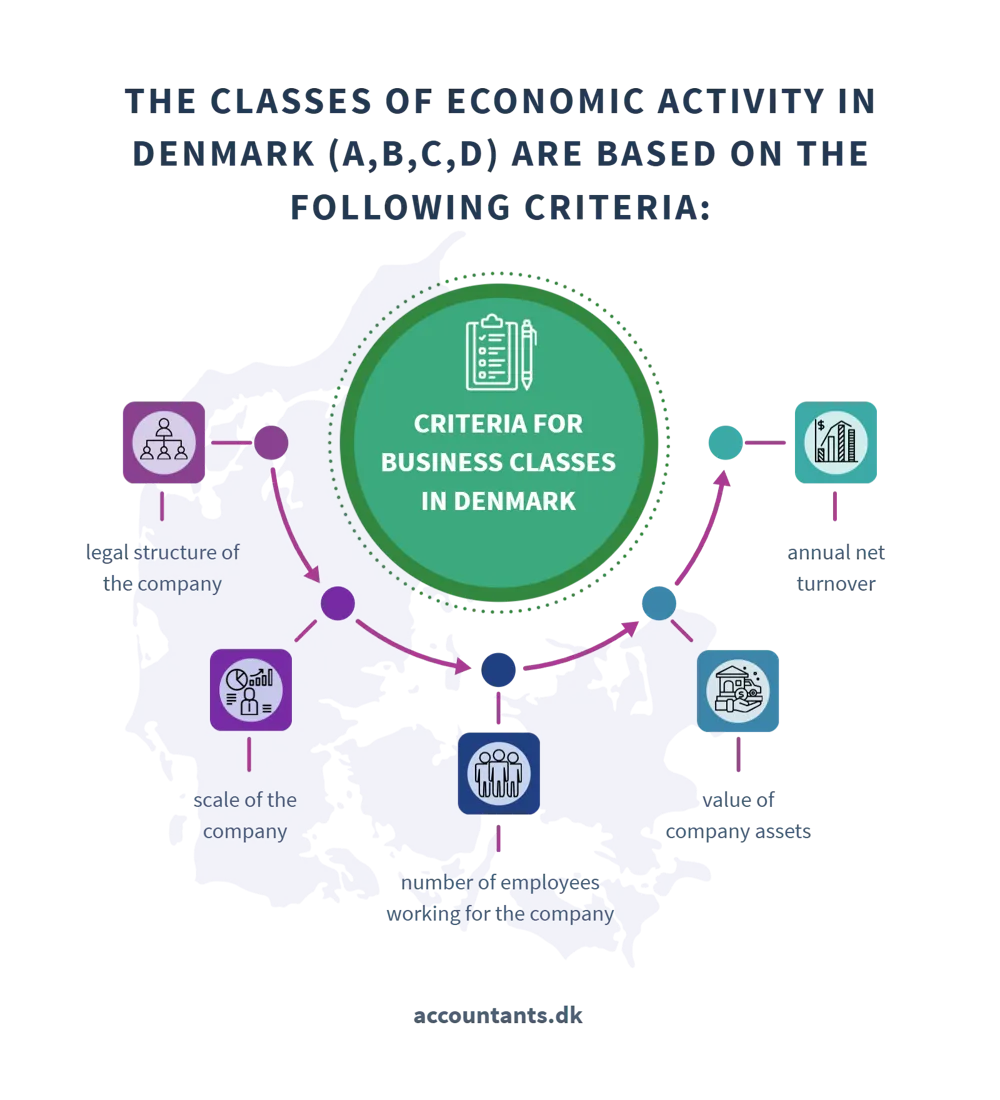

In the accounting sphere of companies operating in Denmark, there are important points regarding the creation of financial statements, which are defined in the Financial Reporting Act. This regulation divides all given business activities in Denmark into four classes (A, B, C and D), based on the following criteria:

- legal structure of the company,

- scale of the company,

- number of employees employed by the company,

- the value of the company's assets,

- annual net turnover.

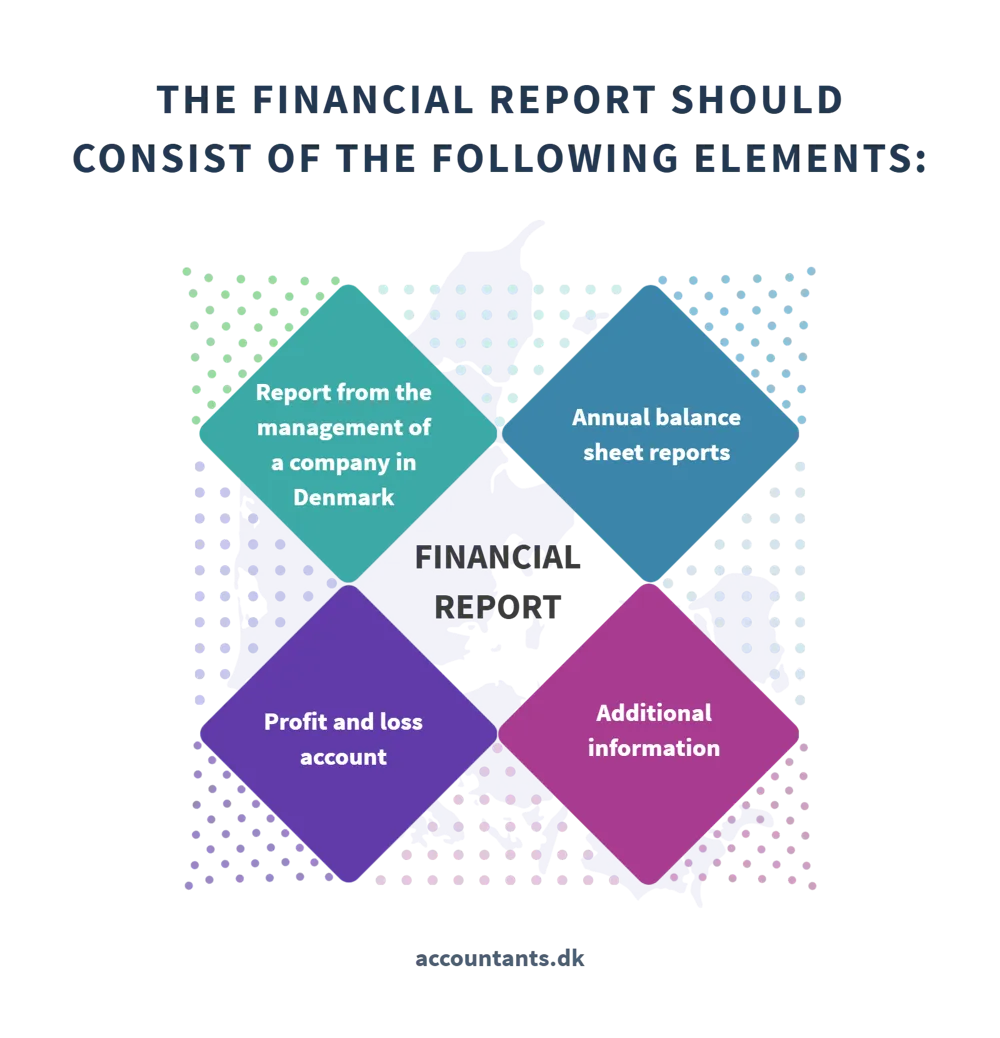

If the company's situation falls within the framework of financial reporting regulations, the report should consist of the following:

- a report from the company's management in Denmark,

- annual balance sheet statements,

- profit and loss account,

- additional information.

Class A - includes all private companies in Denmark, regardless of their scale, with no more than 10 employees (full-time). The value of the assets of these companies does not exceed DKK 7 million, and the annual net turnover is a maximum of DKK 14 million. The preparation of financial statements for Class A companies is not mandatory under Danish law (although there may be specific provisions in the company's articles of association), unless they are required for tax purposes.

Class B - includes both public and private limited partnerships, commercial foundations and other companies. Criteria include:

- employment of up to 10 full-time employees, asset value of up to DKK 2.7 million, and annual net turnover of up to DKK 5.4 million,

- employment of up to 50 full-time employees, an asset value of up to DKK 44 million, and an annual net turnover of up to DKK 89 million.

Prepared financial statements for Class B companies should include:

- a summary of the company's management activities,

- annual balance sheet,

- profit and loss account,

- a list of changes in capital,

- additional information.

Class B companies can use the superstandard directives issued by the DASC in 2013 or IFRS. Some of the guidelines, especially on valuation and presentation of information, are optional for companies in this class and mandatory for Class C companies.

Class C - includes large and medium-sized companies, both public and private limited liability companies, limited partnerships and commercial foundations. The criteria are:

- up to 250 full-time employees, an asset value of up to DKK 156 million, and an annual net turnover of up to DKK 313 million,

- more than 250 full-time employees, an asset value of more than DKK 156 million, and an annual net turnover of more than DKK 313 million.

Financial statements for Class C companies should include:

- a summary of management's activities,

- annual balance sheet,

- income statement,

- cash flow statement,

- statement of changes in capital,

- additional data.

Class D - includes all state-owned joint stock companies, which are required to prepare consolidated financial statements in accordance with IFRS guidelines (the statute of limitations is May 1 after 4 or 6 years). In addition, listed companies are required to prepare individual financial reports.

The reports of these companies should include:

- a summary of the company's management activities,

- annual balance sheet,

- income statement,

- cash flow statement,

- list of changes in capital,

- additional information.

The legal context of Danish accounting

Denmark, being one of the Scandinavian region's caring countries, clearly has a strong influence on social policy, a flexible labor market, robust social benefits and expansive taxation.

Entrepreneurs who choose to start a business in Denmark should familiarize themselves with accounting regulations, which cover financial and accounting records.

The following are acts related to accounting in Denmark:

- Accounting Act of 1998 - which contains provisions on accounting principles, bookkeeping and business records. As part of Danish accounting, the chart of accounts is important, which includes the structure of the income statement (the first group of accounts relates to sales revenue and 6 groups of costs) and the structure of the balance sheet (assets, liabilities, capital).

- The Financial Reporting Act of 2001 (DFSA amended in 2015) - which includes provisions for preparing financial statements. Distinguishes between two types of income statement - comparative and calculation, with the Danish income statement templates not including a net profit reduction model. Financial reporting applies to different classes of Danish companies:

- Class A, comprising companies run by individuals; in this case there is no obligation to prepare financial statements, and tax returns are the main source of information.

- Class B, covering Danish public companies, limited liability companies and limited partnerships (with up to 50 employees and assets of up to DKK 36 million).

- Class C, comprising Danish public companies, limited liability companies and limited partnerships (with more than 50 employees and assets of more than DKK 36 million).

- Class D, comprising Danish joint stock companies. Accounting for such companies is more extensive, involving the creation of balance sheets, management reports, profit and loss statements, financial flows and information on changes in capital and other aspects.

- Class A, comprising companies run by individuals; in this case there is no obligation to prepare financial statements, and tax returns are the main source of information.

Additional relevant company accounting regulations in Denmark include:

- Rules for public companies and LLC in Denmark from 2009.

- Provisions for approved auditors and audit firms, which came into effect in 2008.

- Provisions of the Financial Activities Act, effective as of 2011.

- Rules set forth in the Securities Trading Act of 2012.

Financial reporting requirements for Danish companies are regulated by European Union acts and directives, and then translated into national law. An example is the EU Accounting Directive of 2015, which was implemented as the Financial Reporting Act.

Oversight of areas related to financial accounting, auditing and accounting standards in Denmark rests with two government institutions:

- Over the period, the institution of DFSA, otherwise known as the Danish Financial Supervisory Authority.

- Over the years, the role of the DBA, otherwise known as the Danish Business Authority (formerly the Danish Trade and Companies Agency until 2012), which operated under the wing of the Ministry of Economic Affairs and Development, has been taking a new shape in overseeing financial reporting for businesses that are not financial institutions. However, since 2007, the right to set accounting standards in Denmark has been delegated to the Danish Accounting Standards Committee (DASC), which is part of the Danish Auditors' Committee (FSR). Although the DASC has no formal legal basis, its guidelines and technical instructions play a key role in shaping high accounting standards in Denmark. The committee sets guidelines for a wide variety of company sizes, including small, medium and large Danish companies in categories B and C.

Documentation and information for entrepreneurs in Denmark

The website of Erhvervsstyrelsen, or the Danish Economic Activity Authority (www.erhvervsstyrelsen.dk), offers a variety of information related to registration, accounting and operation of businesses in Denmark.

Useful data on companies in Denmark is available on the platform https://www.virk.dk. This site contains the following information:

- the company's registration number, or CVR,

- details of the company's name and address,

- the company's establishment and termination dates,

- type of business activity conducted,

- information on the owners, management and shareholders,

- number of employees,

- contact details of the company,

- credit information,

- aspects of accounting, balance sheet and financial reporting, for both individuals and companies (such as Danish private limited companies or joint stock companies),

- business sectors and subsectors,

- related companies,

- accounting standards,

- documentation required to start a business.

Among the relevant documents for doing business in Denmark are:

- Oplysningsskema, which is a tax return form issued by the Danish Tax Authority (SKAT). This form is sent to the address provided during registration and to the taxpayer's electronic mailbox. It's an important document especially for self-employed individuals, which must be completed by September 1 of the following tax year. On its basis, the office draws up årsopgørelse.

- Årsopgørelsen, a document delivered by SKAT on March 15, containing the preliminary tax decision (the amount to be refunded or owed). In the case of erroneous information or eligible deductions, this document can be electronically corrected through the TastSelv platform and sent to the office as an amended return by May 1. For entrepreneurs, this document is prepared later, based on the completed oplysningsskema. The final tax amount calculated in the final årsopgørelsen must be paid to the office by July 1. If the tax is over DKK 21,798, the amount is divided into 3 installments, payable in August, September and October.

- Oplysningsseddel is a document that sums up an employee's earnings. Every Danish employer is required to provide this document to the employee upon termination of employment.

Danish business owners are required to keep employee records (after employment ends) for 5 years.

Compliance with labor and safety laws

Entrepreneurs doing business in Denmark who decide to hire employees must carefully read the Employment Contract Act (Ansættelsesbevisloven). The said legislation deals with the obligation to provide employees with a document containing key information about their terms and conditions of employment. Individuals working in Danish companies often enjoy the protections of collective bargaining agreements, which are contracts setting forth working conditions based on agreements between employers and employees, negotiated by labor organizations or employee representatives.

The country's regulations require employers in Denmark to comply with applicable labor laws and occupational health and safety regulations, available on the website of the Danish Labor Inspection Authority (UIP).

Entrepreneurs in Denmark who employ workers should:

- Provide workers with appropriate protective clothing.

- Secure workers with insurance against accidents and occupational diseases.

- Avoid discriminatory practices against employees.

- Provide workers with adequate compensation.

- Ensure that employees follow safety rules when performing their tasks.

- Create favorable working conditions.

- Minimize the risk of workplace injuries.

- Provide safety and health training for employees.

- Provide regular occupational safety and health training, at least once a year.

- Maintain ongoing cooperation with institutions responsible for occupational health and safety in Denmark.

Employers from European Union countries planning to post their employees to work in Denmark are required to comply with the posting regulations contained in the following documents:

- EU Directive 96/71 of December 16, 1996 on the posting of workers abroad, covering issues such as working environment, equal pay, prohibition of discrimination in the labor market, labor relations and parental leave.

- Denmark's Act Concerning Posting of Workers No. 993, dated December 15, 1999.

Every company in Denmark must be registered with the Danish Commerce and Companies Agency (Danish Commerce and Companies Agency, www.erhvervsstyrelsen.dk), which assigns a Central Company Register number (CVR, www.datacvr.virk.dk). In addition, companies that post workers from abroad are required to report any changes related to their business to the Register of Foreign Service Providers - RUT.

Aspects of financial control in companies in Denmark

The topic of the Danish Financial Reporting Act also touches on the verification of financial statements created by companies in Denmark. The auditing process there is carried out by public auditors who are registered (or authorized), maintain independence and operate externally.

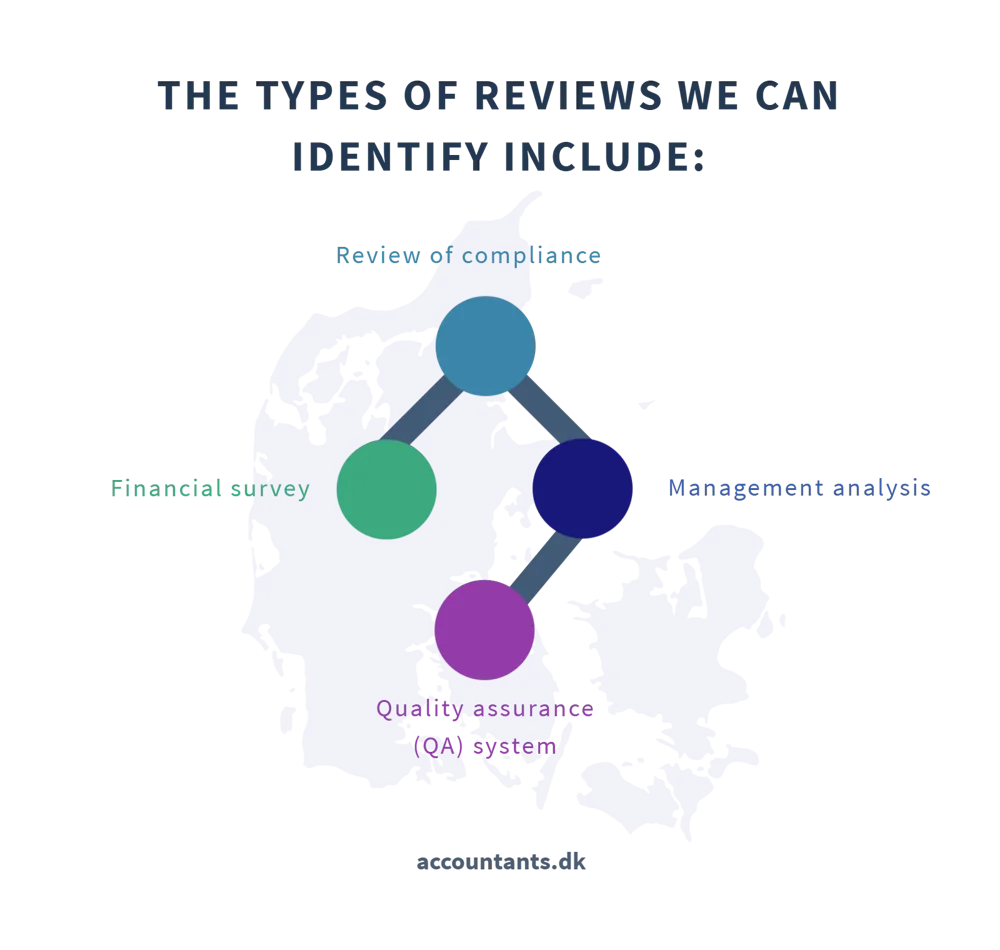

The different types of reviews we can identify include:

- Financial audit - a thorough examination of the financial statements by an auditor. This type of audit is designed to detect whether the financial and asset information presented by the business owner is reliable and whether the financial reports comply with Danish or international accounting principles.

- Compliance review - assessing whether financial activities and systems in companies comply with the law.

- Management analysis - assessing the efficiency and effectiveness of financial resource management in companies in Denmark.

- Quality control (QA) system - the structure of Danish quality control, including, among other things, financial reports.

Two options are available for various B-classification companies in Denmark:

- Conducting a full review of financial reports.

- Choosing a "light" audit, a new form of audit introduced for financial reports since the beginning of 2013.

Financial audits for Class A and B companies in Denmark are not mandatory and depend on the annual revenues earned by the company. These companies have the option of choosing the type of review and working with auditors to decide which certification service (e.g., accounting support, financial report control or audit) is most suitable for them.

Internal auditing should be considered in the planning and modification of Danish companies' accounting systems.

The Law on Auditors sets standards for good auditing practice, ensuring that the internal audit unit is not subordinate to the entity's management in planning, organization and execution. Internal auditors must also have access to the information they need.

The Ministry of Finance in Denmark has the authority to designate areas within companies that will be thoroughly audited. The Danish Financial Supervisory Authority (FSB) follows the International Standards on Auditing (ISA).

In 2011, the FSR was established, an accounting organization that merged three Danish institutions: FSR (Danish Statutory Auditors), FRR (Danish Institute of Certified Public Accountants) and REVIFORA (association of young accountants and trainees). The FSR focuses on auditing, auditing of financial reports and aspects of accounting and taxation for companies in Denmark.

Danish auditors, state authorized public accountants (SPA, or State Authorized Public Accountant), who act as auditors, and audit firms are regularly inspected every six years by the DSAA, or the Audit Supervision Authority (established by the DBA).

Costs, assets and control practices in accounting for Danish companies

The issue of costs and accounting for Danish companies is as important as balance sheets and assets.

The modern balance sheet in Denmark shows assets arranged according to liquidity - from the less liquid (T&E) to the most liquid (cash). Liabilities, on the other hand, are divided into foreign capital and equity. The balance sheet formula is as follows:

In fixed assets:

- intangible fixed assets including intangible assets such as patents, trademarks, concessions related to development projects,

- purchased patents, licenses, trademarks,

- the value of goodwill itself,

- development projects in progress, and contributions to IPC,

- tangible fixed assets, such as buildings, technical equipment, machinery,

- other tangible assets, such as equipment, fixtures,

- property, plant and equipment under development and advances for fixed assets,

- financial assets including shares in affiliated companies, receivables from such companies, investments in affiliated companies.

In current assets:

- inventories, including raw materials, consumables, work in progress, finished goods, merchandise,

- trade receivables, contracts for work in progress, receivables from related and affiliated companies,

- investments in affiliated companies, shares, other investments, cash.

In liabilities:

- capitals including contributed capital, agio, valuation reserve, other reserves, profit or loss,

- reserves, including those related to pension and similar obligations, annual tax, other reserves,

- short-term and long-term liabilities, such as mortgages, loans, advances from customers, trade payables, income taxes, accruals.

Verifications of Danish companies are carried out by authorized auditors, who must be independent and act as external auditors. There are different types of audit, such as financial audit, compliance audit or management audit. Danish companies have the opportunity to choose the appropriate certification service according to their needs.

Denmark's trade cooperation with European partners

In the context of Denmark, countries from the European Union, especially Germany, Sweden, the Netherlands and the United Kingdom, turn out to be important trading partners. Denmark's main exports are food products, live animals, chemicals and chemical goods. Imports, on the other hand, mainly include machinery, equipment, processed goods and chemicals.

Operating as Eksportrådet, the Danish Trade Council has a key function in building international relations between Denmark and other countries. Most products are subject to preferential tariffs, which in most cases are 0%. However, it is necessary to provide customs officials with a EUR1 certificate of origin.

VAT, called MOMS in Denmark, at 25%, covers most industrial, agricultural and service products. There is a variety of excise duties that cover categories such as ice cream, coffee, videotapes, tobacco products, alcohol, chocolate products, light bulbs, beer, wine, tea, cars, fuel and disposable packaging.

Denmark has Fødevarestyrelsen, or the Danish Food and Veterinary Inspectorate, which oversees the issuance of permits and licenses for food imports. Food products must be described in Danish and meet standards for ingredients and preservatives.

The Ministry of the Environment oversees the entry of cosmetics, detergents and cleaning products into the Danish market. Companies planning to import chemicals must meet the Ministry's criteria. Chemicals outside the EINECS list should be notified to the Department of Chemical Products.

Under the New Approach directives, many industrial products, such as toys, appliances and gas machinery, must be CE marked.

Denmark has entered into a number of major agreements, including the Economic, Energy and Environmental Cooperation Agreement. In addition, it has signed the UN Convention on the International Sale of Goods.

Common concerns

- Accounting in Denmark is based on regulations related to accounting rules. Denmark has EU Regulation 1606/2002 on International Accounting Standards (IAS), which requires the use of EU-approved IFRS standards. This is particularly important for European companies listed on securities markets. It is also possible to use IFRS standards in consolidated statements and for Danish companies that do not operate on a regulated market. It should be mentioned that in the two autonomous territories of Denmark, the Faroe Islands and Greenland, EU regulations do not apply.

- A-kasse is an insurance fund that provides support in situations of unemployment. Although this insurance is not mandatory, you must be a member of a-kasse to receive unemployment benefits.

- Is it possible to settle electronically with the Tax Office in Denmark? Yes, there is an option for electronic billing in Denmark using the TastSelv code, which consists of 8 digits. This code can be ordered online at www.skat.dk. The code number can be found on your Årsopgørelsen or Forskudsopgørelsen (tax card).

- Skat til udbetaling is a term that appears in a tax decision, indicating the amount of tax to be refunded.

- The expression Restskat til betaling in a tax decision indicates that additional tax must be paid.

- NemKonto is the employee's bank account into which tax refunds and wages are transferred.

- Feriepenge is a vacation payment to which anyone working legally in Denmark is entitled. For each month worked, you are entitled to 2.08 days of vacation, making a total of 25 vacation days (or 5 weeks). You can apply for Feriepenge within 6 months of leaving work in Denmark, however, you must deregister with the Folkeregister (municipal office) before leaving the country. Feriepenge is paid into your NemKonto account during the first 3 months of the fiscal year, which runs from September 1 to August 31 of the following year. They can be used from May 1 to April 30 of the following year.

- Feriekonto is a special fund into which employers pay employees' vacation contributions (12% of gross salary less 8% for social purposes).

- It usually takes about 6 months to get a tax refund from the Danish Tax Authority.

- Årsopgørelsen is a tax decision available on the Danish Tax Authority's website.

- Personfradrag is a personal tax credit available to Danish residents who have worked there for 12 months.

- Various tax credits are available in Denmark, such as the commuting tax credit, the housing tax credit and the food tax credit.

- Pension is a private pension in Denmark, based on pension funds (PFA Pension, Danica Pension, Industriens Pension, Pensiondanmark).

- Folkepension is the state pension in Denmark, available to citizens after age 65.

- ATP is the pension programs in Denmark, part of the second pillar of the pension system, covering all citizens from the age of 16.

- Sundhedskortet is a health card, needed for those intending to stay in Denmark for more than 3 months. It provides free medical care (except dentistry) and is issued together with a CPR (registration) number.

When carrying out important administrative formalities, it is necessary to take into account the risk of errors and their potential legal and financial consequences. To minimize the risk, it is recommended to consult a specialist.